Kenya Power has commenced a pilot project to install special utility poles that will aid in the supply of high-speed internet as part of its revenue diversification plan.

Once the pilot phase is complete, the utility firm eyes installing the smart poles within its overhead network, which telecom service providers will lease to mount their wireless transmission equipment.

The pilot project is being undertaken in partnership with Safaricom at six unspecified locations within Nairobi.

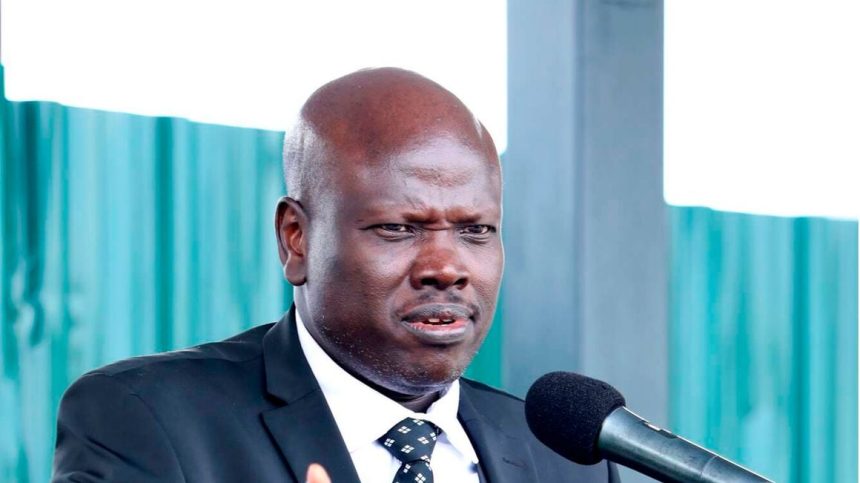

“The smart poles will provide an alternative way to deploy the last mile data networks using wireless technologies, thus providing a solution to telecom service providers to improve data coverage and capacity, as well as address the challenge of signal dropouts,” said Kenya Power’s Managing Director Joseph Siror.

Dr Siror further disclosed that apart from piloting the smart poles, the electricity distributor is in talks with the ICT ministry to develop a framework for realising the government’s digital transformation agenda.

“With our wide network and fibre capacity, we intend to provide infrastructure for internet connectivity targeting public institutions such as schools and hospitals at a favourable cost,” he said.

Internet business

Kenya Power’s foray into the internet business comes against increased demand for telco firms to expand last-mile data networks.

In its annual report for the year ending June 2022, the State-owned firm said that it had installed over 7,000 kilometres of overhead fibre optic cables attached to its power transmission lines across 44 counties. The cables are leased to 25 internet service providers for dark fibre services.

Kenya Power hopes that the internet business will become a sustainable revenue stream in the near term to supplement its electricity-selling business.

Last month, the firm issued a profit warning signalling that its earnings for the current financial year ended this month will be at least 25 percent lower than the Sh3.5 billion net profit posted in the year to June 2022.

The company has already posted a net loss of Sh1.1 billion for the half-year ended December 2022, attributing the looming drop to the widening foreign exchange losses.