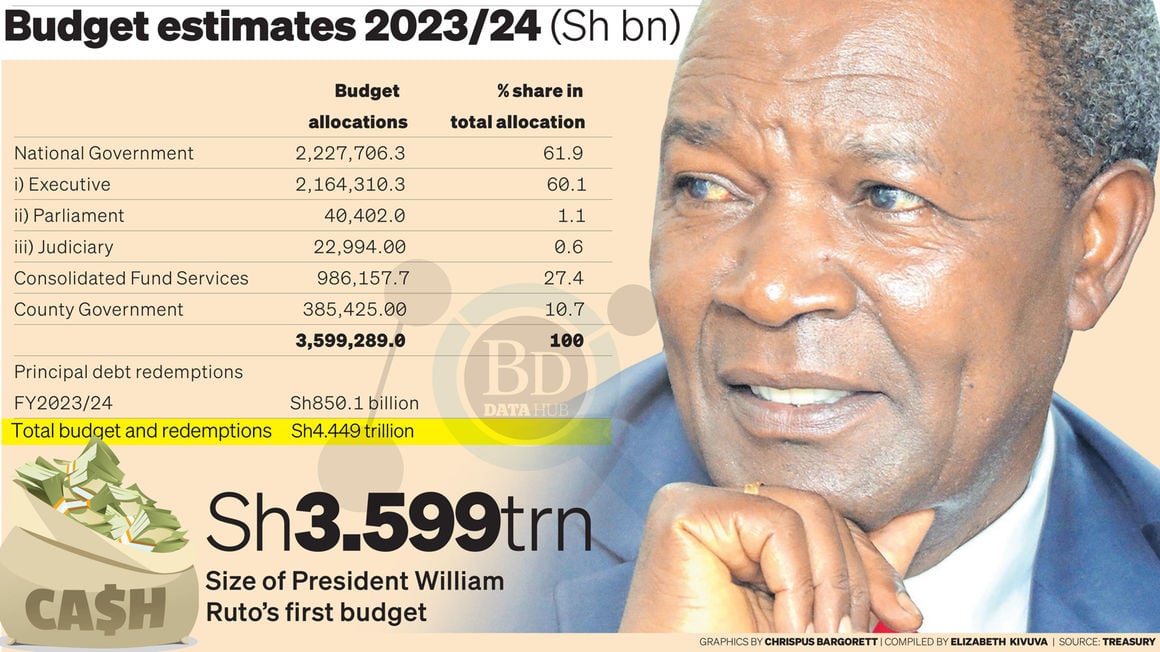

The Kenya Kwanza administration has hit salaried workers and the middle class hard in its search for Sh211 billion in additional taxes to fund its first Sh3.6 trillion Budget, further squeezing incomes that are under pressure from high inflation.

In keeping with the tone set by the Ruto administration to go after those it considers privileged to help uplift the poor, amendments to the Finance Bill 2023 by the Budget and Finance Committee of the National Assembly target the middle class for higher taxes and levies while offering some reliefs to low-income earners.

The policy where the less well-off gain economically at the expense of the better-off is popularly known as the Robin Hood effect.

The committee has removed the Sh2,500 cap on contributions to the housing levy, while maintaining the higher VAT on fuel and the new tax band of 35 percent for top earners.

Converting the proposed 3.0 percent housing fund into a levy of 1.5 percent means that employees earning above Sh167,000 per month will see their contribution breach the previous ceiling of Sh2,500.

Finance committee chairman Kuria Kimani says this will bring fairness and equity in the contribution across different salary levels.

He says among the issues he deems most daunting for the government is how to mobilise the targeted Sh2.8 trillion worth of revenue in an economy that is still reeling from shocks.

Speaking ahead of the budget speech, Treasury Cabinet Secretary Njuguna Ndung’u described the macroeconomic environment defining Kenya Kwanza’s debut Budget as “the perfect storm”.

Prof Ndung’u said that preparing the Sh3.6 trillion spending plan has been a delicate balancing act as the government seeks to unlock new revenue through the much-debated Finance Bill 2023.

“It’s the first Budget that I am going to present…It is also the first Budget under the Bottom Up Economic model. The premise of that is that we are coming from a very devastating kind of economic slowdown. We call it a perfect storm if you want to replicate what the Economic Advisory Team of the President has said,” Prof Ndung’u said in an interview on Wednesday.

“Why is it a perfect storm? Even before we could overcome Covid-19, there were supply-side disruptions on cost of energy. Then came a devastating drought the kind of we haven’t seen in 40 years.”

The man who previously wore a monetary hat and now dons a fiscal one noted the economic landscape had changed significantly ever since he exited the Central Bank of Kenya.

“When I was the Governor of the Central Bank of Kenya, our tax revenue to GDP ratio used to be 22 percent. I have come to realise it has gone as far down as 13.7 percent and now we are moving back to 15.8 percent.

So you can imagine, a movement from 22 percent to 13.7 per cent is very devastating. You can imagine how much space we have to cover,” said the Treasury boss, who faces a Sh720.1 billion budget deficit in the 2023/2024 fiscal year.

The parliamentary committee also retained the proposal by the Treasury to raise the top band for Pay as You Earn (PAYE) taxes to 35 percent (for earnings above Sh500,000 per month), despite submissions by multiple petitioners arguing that a majority of wage earners fall well below this threshold.

The committee, however, amended the Treasury’s proposal by inserting an additional band which will see wages falling between Sh500,000 and Sh800,000 attract a rate of 32.5 percent, with those above Sh800,000 being liable for the 35 percent hit.

The lower tax bands were, however, left unchanged in both the Treasury’s proposals in the Finance Bill and the committee’s amendments.

The additional levies and taxes on pay slips have been proposed just months after a five-fold increase in the amount contributed to the State-backed National Social Security Fund (NSSF) to Sh1,080 for top earners, which has further reduced the take-home pay for workers.

Kenyans are also set to contribute more towards the National Health Insurance Fund (NHIF) once draft regulations meant to actualise amendments done in 2022 to the NHIF Act (1998) are gazetted.

Under the new regulations, salaried persons who were contributing between Sh150 and Sh1,700 depending on pay level will now pay a standard rate of 2.75 percent of gross monthly salary for the NHIF cover.

A self-employed person will be expected to make a special contribution of 2.75 percent of the declared or assessed gross monthly income, subject to a minimum of Sh300, changing from the current flat contribution of Sh500.

Government officials, including President Ruto, have previously insisted that the deduction for affordable housing is not a tax but a contribution just like that to the NSSF.

Mr Kuria, who is the Molo MP, however, said in a TV interview on Tuesday night that the funds will now go to the consolidated fund, effectively rendering the contribution a tax.

It means contributors who miss out on the promised affordable homes cannot claim a refund after seven years as was envisaged in the Finance Bill before the amendments.

“The proposal as given to us by Treasury was discriminative to people down the tax bands and advantageous to those earning more. We are reducing to a flat rate of 1.5 percent so that the person earning Sh30,000, or the one earning Sh500,000 or Sh6 million gets to pay the same percentage of their income,” said Mr Kuria.

The Ruto administration is championing affordable housing as part of the President’s bottom-up economic model, arguing that it will help eradicate slums and create employment through the construction of 250,000 houses annually.

Critics, however, say that the contribution will reduce the take-home salary for workers who are already grappling with inflationary pressures.

The parliamentary committee also declined to effect multiple requests to review the clause that reinstated full VAT charges on fuel, arguing that keeping it at eight percent would be tantamount to offering a subsidy that was distorting the fuel market.

While coming down hard on wage workers however, the committee offered relief to other sectors that had been targeted for higher taxes in the Finance Bill.

The committee quashed the proposed excise duty of five percent on wigs, false beards, eyebrows, eyelashes and artificial nails, citing a need to aid the recovery of the beauty sector after the Covid-19 pandemic.

It also cut the proposed withholding tax for those monetizing digital content from 15 percent back to five percent, and reduced the excise on betting, gaming and lottery stakes from the proposed 20 percent to 12.5 percent. These stakes currently attract excise of 7.5 percent.

Others enjoying tax reliefs are landlords, whose tax on rental income has been reduced from 10 percent to 7.5 percent, and importers whose declaration levy has been cut from 3.5 percent to 2.5 percent. The railway development levy has also been cut to 1.5 percent from two percent in the Finance Bill.