Prices of imported furniture and fuel are expected to rise with the new taxes, even as consumers get a reprieve on products and services such as beauty items and mobile money transfers.

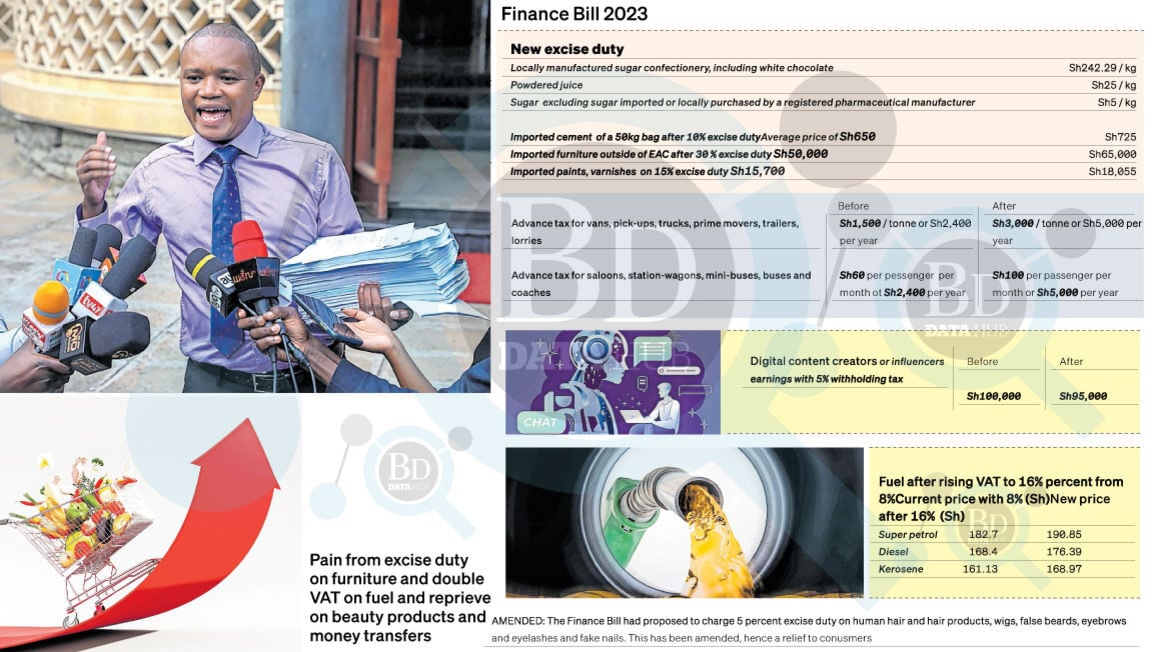

The government, in new measures proposed under the Finance Bill 2023, is seeking to introduce a 30 percent excise duty on imported furniture, excluding furniture originating from East African Community partner states.

It is also seeking to introduce a 16 percent value-added tax (VAT) on petroleum products from the current 8.0 percent.

This will see the price of super petrol in Nairobi, for instance, rise to Sh190.85 from Sh182.7 and that of diesel to Sh176.39 from the current Sh168.4. Kerosene will increase to Sh168.97 from Sh161.13.

“The current VAT regime for petroleum products is akin to subsidising the product by the government and therefore it has created market distortions. The committee notes that the effect of differential VAT on fuel has led to oil marketing companies being in a constant credit position, thus leading to high tax expenditure for the government,” the parliamentary Finance Committee noted.

Setting excise duty on furniture at 30 percent means a piece that would cost Sh50,000 will rise by Sh15,000.

The turnover tax band has been widened to Sh1 million up to Sh25 million from Sh1 million to Sh50 million under the Finance Bill 2023, which targets additional revenues of Sh211 billion from the taxes.

Taxpayers making payments to digital content creators will also be required to withhold against such payments at the rate of five percent effective September 1, aligning with the rate applicable to professional services.

Before the proposed amendment, the tax had been set at 15 percent.

Consumers have, however, got a reprieve from an amendment on a proposed five percent excise duty on human hair, eyelashes, switches and artificial nails, which would have increased the prices of the beauty products whose usage is on the rise.

The committee has made a turnaround on the tax, saying taxing the beauty products ‘’is likely to push many young men and women out of business since the beauty industry has employed many people who could be pushed out of the business if the people clients are no longer able to afford their services.’’

It said the removal of the tax will allow the industry to recover from the post-Covid slump.

“The committee agreed with the proposal to delete clause 43 (a) paragraph (vi) to align with the need to keep beauty products for women at an affordable level,” it added.