The Court of Appeal has lifted an order issued last month suspending the implementation of the Finance Act 2023 after Treasury CS Prof Njuguna Ndung’u argued that the government loses half-a billion shillings daily, following the freeze.

A bench of three judges of the appellate court lifted the suspension placed on June 30, pending the determination of an appeal filed by Prof Ndung’u.

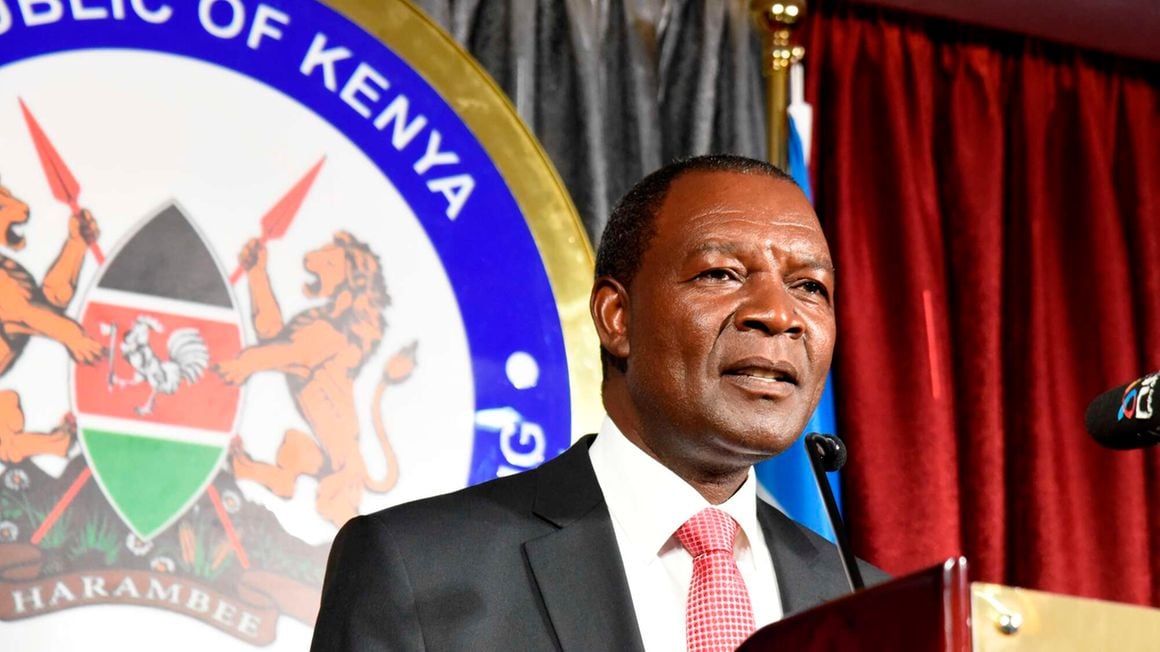

The CS moved to the appellate court through Attorney General Justin Muturi arguing that the government stands to lose approximately Sh211 billion in the current financial year.

Prof Ndung’u said the freeze will make it difficult for the Kenya Kwanza administration to implement the 2023/24 budget as planned and some projects have to be suspended, if the government is not allowed to raise revenue as proposed in the Bill.

Justices Mohammed Warsame, Kathurima M’Inoti and Hellen Omondi ruled that the Finance Act has a life span of 90 days beyond which the next budgetary cycle is set in motion.

“We have no doubt in our mind that the Finance Act and the Appropriation Act are interdependent. While the former provides for generation of the funds, the latter provides for the expenditure. There can be no expenditure where the mode of generation of the funds has not been provided for,” the judges said.

The judges said Prof Ndung’u had estimated to generate Sh211 Billion with an average daily rate of Sh500 million. “Despite the actual figures being contested, it is certain that revenue was to be collected with the operationalization of the Act,” the judges said.

Prof Ndung’u had urged the court to lift the order, which was extended by the High Court on July 10, arguing that the government has to borrow to bridge the gap in order to operate.

“As there are no saving provisions in the Finance Act, 2023, the repealed provisions of the Finance Act 2022 has the effect of affecting revenue collection leading to service disruptions for already budgeted revenue,” Prof Ndung’u said in an affidavit.

In the ruling, the three judges said tax is a continuous and annual mechanism and the members of the public can get a rebate for overpaid taxes and levies when making subsequent tax payments.

Secondly, the judges said, since the petitions challenge both the entire Act and the specific provisions, the court can consider suspending the specific provisions whose implementation has an irreversible effect and cannot be refunded.

“This is in contradistinction with a blanket suspension of the Act. Thirdly, the Appropriation Act which was enacted on the backdrop of the Finance Act is in place and is not under constitutional challenge. Lastly, had the trial Judge considered the substantial and irreversible public interest in this matter, the court would have been hesitant to suspend the whole Act,” the judges said.