A new central bank bond trading platform that went live on Monday has granted retail investors in Kenya and abroad unprecedented access to attractive returns via the mobile phone, opening up a sector that has hitherto been the preserve of a small club of sophisticated and deep-pocketed investors.

The Central Bank of Kenya’s central securities depository, known as the CBK DhowCSD, started onboarding new investors on Monday.

Its launch comes at a time government securities are giving double-digit returns compared to other asset classes such as equities, which are posting negative returns.

The existing investors, whose details have already been pre-populated on the platform, were setting up accounts to generate log-in credentials and passwords.

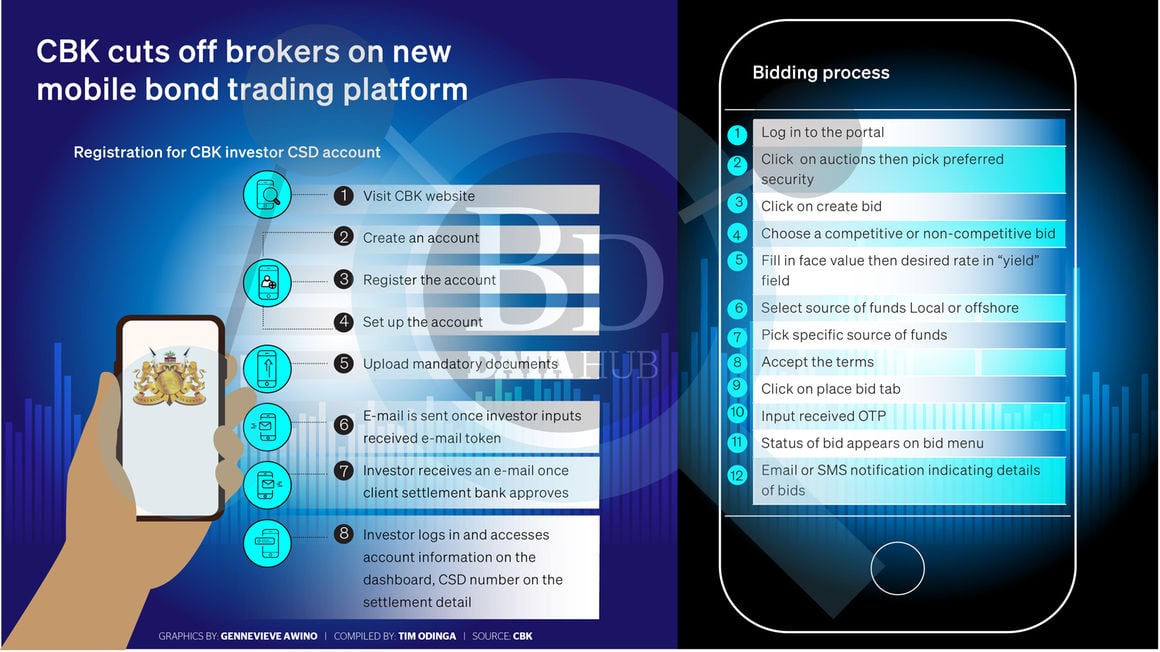

The platform, which has been in the works for three years, allows investors to open bond trading accounts at the CBK online, from where they will be placing their bids for their preferred securities during auctions.

Trading in bonds in Kenya has picked up in popularity in recent years among retail investors, partly due to limited returns in other asset classes such as equities and property.

Retail investors—who include saccos, listed and private companies, self-help groups, educational institutions, religious institutions and individuals—have raised their holdings of government debt to Sh337.3 billion from Sh136 billion three years ago, making them the fastest growing bonds investor class ahead of banks, insurers, pension funds and parastatals.

A brochure on the new service by the CBK also shows that existing account holders, who have been bidding for securities manually or through the Treasury Mobile Direct Service, will have their details transferred to the new CSD.

“CBK is discontinuing manual submissions/drop off of bids at its centres. Investors will no longer be able to submit manual bids to participate in auctions. Bids will be done through the DhowCSD,” said the CBK.

The State has over the years sought to raise the volume of investment in its debt by these investors, seeing it as one way of increasing the country’s ratio of gross savings to GDP, which has remained in the single digits for years.

In 2017, the State piloted the mobile-based M-Akiba bond, which allowed a minimum investment of just Sh3,000.

The programme raised Sh1.04 billion from five issues and a total of 582,572 registrations, proving to the government that there was sufficient demand from retailers for securities if access could be made more friendly.

By deepening the market and improving its transparency, the Treasury also hopes to lower its own cost of borrowing by tapping a wider pool of funds.

The government securities market is dominated by banks and pension funds, which collectively hold 79.6 percent of the Sh4.76 trillion in the government’s domestic debt.

However, despite the rising awareness of the potential of lending to the government, retail investor access to the market has been limited by a lengthy and complicated process of opening trading accounts at the CBK.

Before the new portal was introduced on Monday, such an undertaking involved physical visits to the regulator’s offices and endorsement by one’s commercial bank.

Placing of bids without the help of an intermediary (stockbroker or bank) has also been complicated for many, locking out, especially those living away from large urban centres where these financial institutions are found.

Kenyans living abroad have also faced similar difficulties in accessing the securities market, which has denied the CBK a share of the billions of dollars they remit home every year for investment purposes.

In February, the CBK estimated that it could tap more than Sh412 billion ($2.9 billion) from Kenyans abroad via the simplified bonds investment platform.

The diaspora last year remitted a total of $4 billion (Sh569 billion) to the country, majorly sent to relatives to facilitate investments or for their own consumption.

“The CSD provides a new and easy way to invest in government securities and will, therefore, be beneficial to the diaspora. They don’t need to come back to Kenya to make investments in the T-bills, T-bonds, among others,” former CBK governor Patrick Njoroge, who championed the product, said.

Kenya borrows from the domestic market through short-term Treasury bills, which are repayable within a year and longer-dated bonds, with the latter currently tradeable on the Nairobi Security Exchange’s (NSE’s) fixed income board.

While the secondary bonds market will continue to trade at the exchange, the new platform will open a new avenue for trading in T-bills, which currently can only be offloaded by rediscounting (selling them back to the central bank).

The one-year T-bill has, however, been tradeable in an OTC [over-the-counter] market at the CBK.

Investors can now sell or buy T-bills from each other through the portal, a move which will unlock liquidity in the short-term securities while protecting investors from the punitive charges they previously faced when rediscounting the same at the CBK.

Aside from investors, the new system will also enable banks to trade with each other by exchanging collateral of their Treasury holdings, which will help smaller lenders to get more favourable interbank rates than they do presently.

This form of horizontal repo is seen as key in rebalancing the interbank market, in which the large banks currently enjoy a large share of liquidity compared to their smaller peers.

Currently, small lenders get expensive interbank rates when borrowing from their big peers because they are considered risky and do not offer collateral for their overnight loans.

This risk aversion among the large lenders set in from 2015, following the collapse of three-tier III banks (Dubai Bank, Imperial Bank and Chase Bank) in quick succession.

Big banks borrow from each other without collateral, confident in their balance sheets and potential to access additional funds from their shareholders.