Banks are aggressively going after high-profile clients, including giant corporations and prominent billionaires, amid a fresh wave of corporate defaults that are leaving lenders with a pile-up of bad loans.

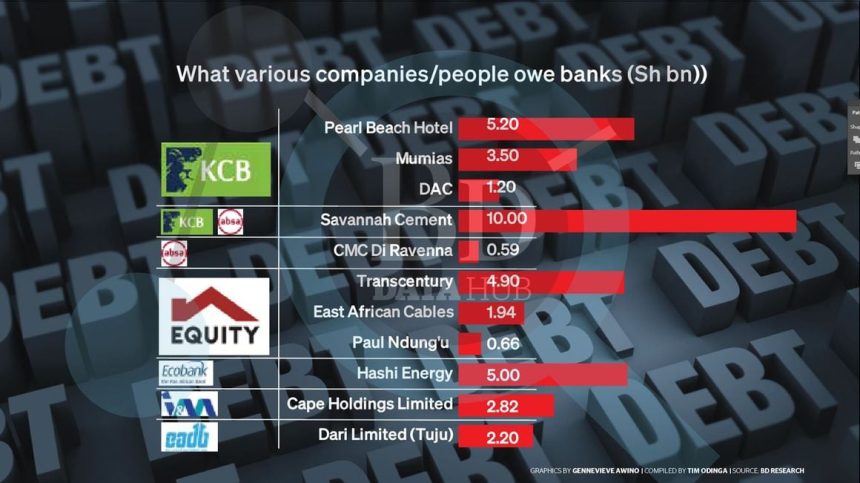

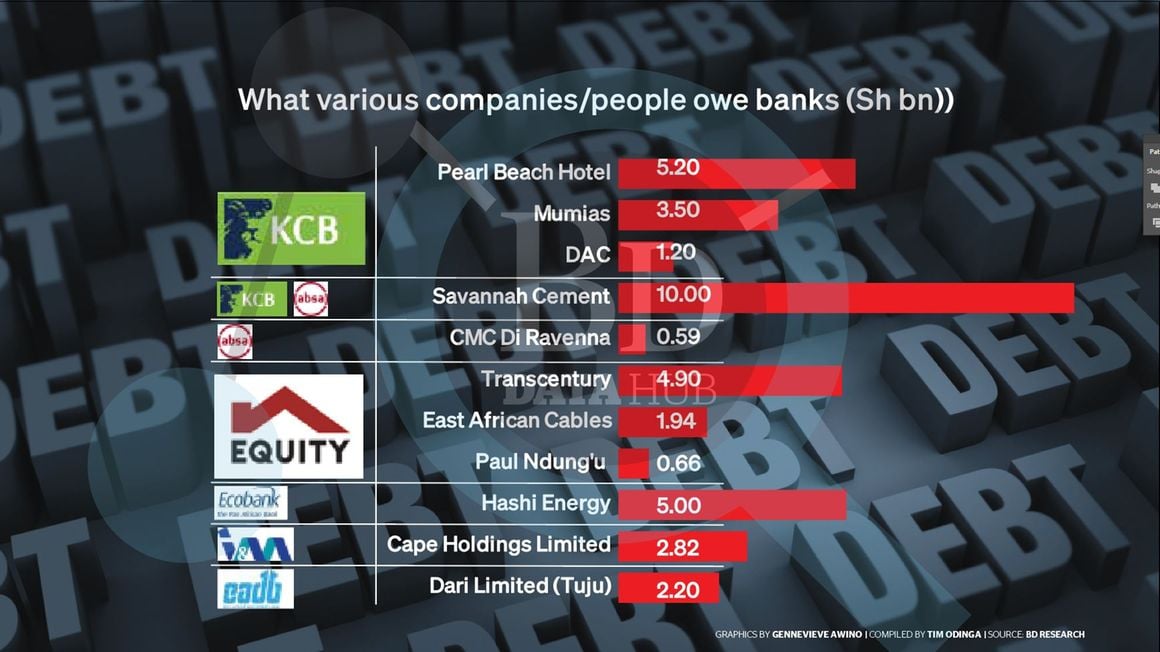

Ecobank is the latest to tap the services of auctioneers as it moves to sell properties belonging to Kenyan oil marketer Hashi Energy in Nairobi, Nakuru, Kisumu, Eldoret and Mombasa counties to recover a Sh5 billion debt.

A number of other banks, including KCB, Equity Group and Absa Bank Kenya, have moved to courts seeking orders to seize assets of defaulters, reflecting a tough business environment where economic activities have been largely muted.

KCB Group, Kenya’s largest bank by asset size, has been the busiest in the courts, applying for the seizure of various properties for unpaid loans running into billions of shillings.

Nine days ago, KCB seized the second hotel belonging to the embattled owners of the Mombasa luxury property English Point Marina over non-payment of a Sh5.2 billion loan, as the listed lender tries to cut its non-performing loans (NPLs).

Earlier, an administrator appointed by KCB and Absa invited creditors to file their claims against troubled Savannah Cement after the company was placed under administration by the two lenders over a Sh10 billion debt. Absa is demanding Sh7 billion from the cement manufacturer, with the rest owed to KCB.

KCB also recently placed DAC Aviation under administration for an unpaid loan of Sh1.2 billion. Also on KCB’s list of defaulters is Mumias Sugar from which it is claiming Sh3.5 billion.

Equity, the region’s most profitable lender, is demanding over Sh6 billion from TransCentury Plc and its subsidiary East African Cables Limited.

The bank placed TransCentury under receivership over non-payment of a Sh4.9 billion loan. Receivership means that the lender has been given the green light to liquidate TransCentury.

The investment firm, which recently raised Sh538 million from the targeted Sh2 billion cash call from investors, now faces a survival battle after Equity rejected its debt repayment plan, terming it “unacceptable.”

Billionaire Paul Wanderi Ndung’u in May lost a case in which he sought to stop the auction of his properties over a Sh664.8 million loan owed to Equity, paving the way for the lender to liquidate the assets that were used as collateral.

The properties that were put up for auction included prime residential property sitting on 2.8 acres in Nairobi’s Gigiri and a 600-acre commercial farm in Laikipia County.

However, East African Cables, a subsidiary of TransCentury, has been placed under administration which means it will continue running as a going concern.

Administration offers East African Cables the chance to pay off its debt of Sh1.94 billion to Equity and avoid liquidation.

I&M placed Cape Holdings Ltd (CHL), which owns DusitD2 Hotel, under administration as it seeks to recover Sh2.82 billion.

Joshua Oigara, the CEO of Stanbic Bank, which has doubled its provisions for bad loans, told the Business Daily that banks have been working with their customers over time to resolve outstanding matters.

“When you see the bank coming up with auction notices and recovery actions, it is largely because the agreed structure for resolution has not been met by the client,” Mr Oigara said.

“At the end of the day, there has to be a limit on how much you can extend recovery efforts to clients.”

Recently, the bank put up a tea estate in Nandi and office blocks belonging to billionaire businessman David Langat’s empire for auction. But it has since withdrawn the auction notice, saying the matter has been resolved.

Banks have been under pressure from the Central Bank of Kenya (CBK) to bring down their NPLs in what is aimed at maintaining financial stability.

NPLs — loans that have not been serviced for over 90 days— as a percentage of gross loans have been rising as borrowers struggle with a tough economic environment

Net NPLs rose to a high of 14.9 percent in May, the highest since 2007, before it dropped to 14.5 percent in June.

High levels of bad loans compelled the KCB Group CEO Paul Russo to set up a special team tasked with recovering billions of unpaid loans and which reports directly to him.

The tightening of interest rates by central banks might have made matters worse, with some borrowers struggling to service the costly loans, according to the Kenya Bankers Association (KBA) in a research note.

“Going forward, expectations of a slowdown in economic growth and the rising interest rates are likely to further exacerbate credit risk, thereby slowing down private-sector credit loan growth in the near to medium term,” says the KBA research note.