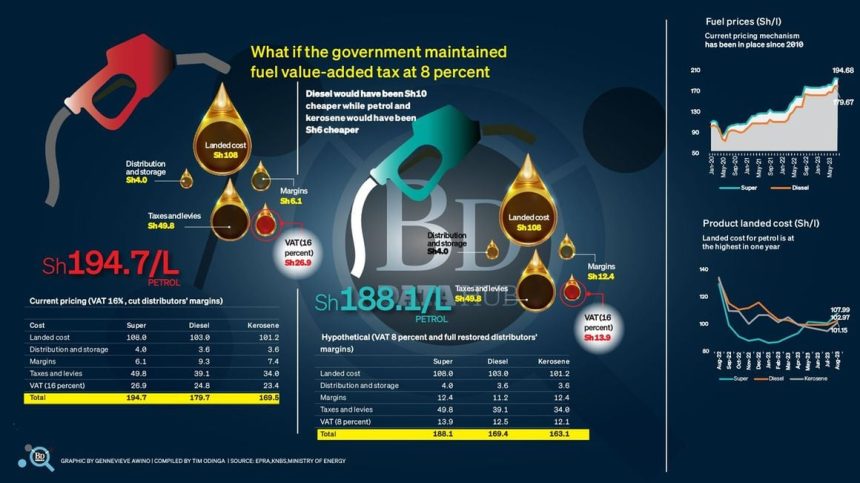

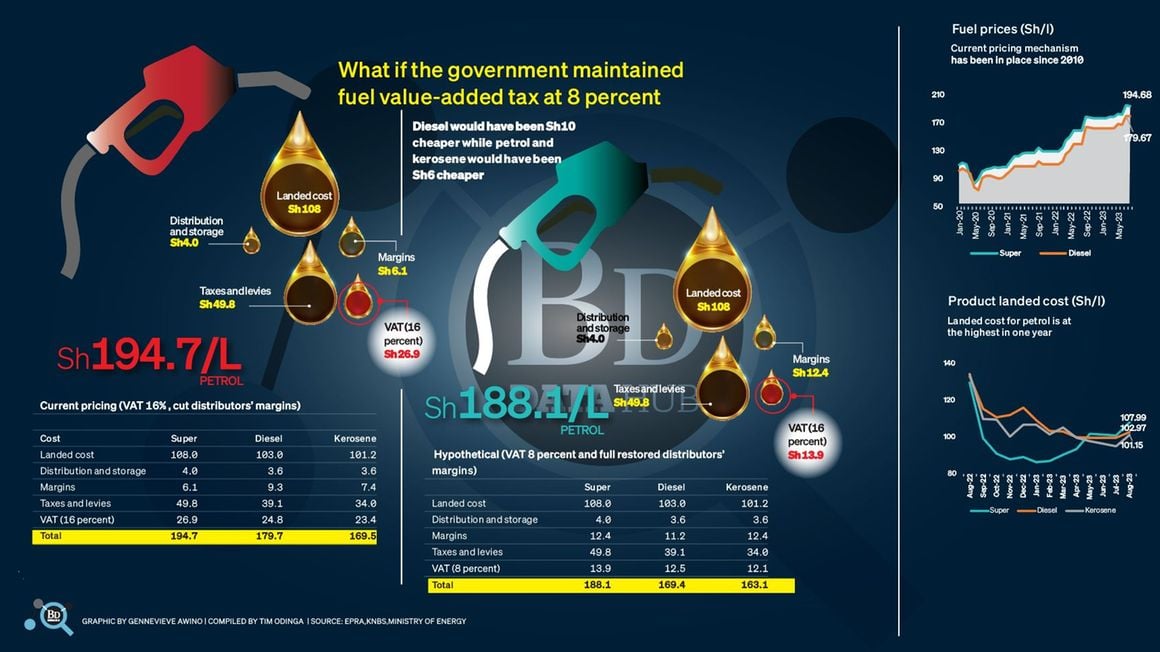

The doubling of the value-added tax (VAT) on fuel to 16 percent is the major driver that pushed petrol prices beyond the 200 mark, forcing the hand of the government to intervene through the stabilisation kitty.

Without the tax, consumers would have enjoyed even lower pump prices than the current ones despite landed costs being higher than in recent months, an analysis has shown.

Diesel would be retailing at Sh169.3 per litre, which is Sh10 less than the current pump price, while super and kerosene would be Sh6 lower than the prevailing prices of Sh194.7 and Sh169.5 per litre.

The stabilisation mechanism is meant to mitigate the rising global prices that have touched an eight-month high with super trading at $880.67 per tonne in July.

The decision to cushion consumers from high global prices using a stabilisation mechanism has come under scrutiny following the move to double VAT to 16 percent from July.

The Energy and Petroleum Regulatory Authority (Epra) said without the stabilisation, the prices of petrol would have risen to Sh202.01 a litre, diesel to Sh183.26 a litre and kerosene would have increased to Sh175.22 a litre.

But the intervention in prices will remain unchanged at Sh194.68 (petrol), and Sh179.67 (diesel) while kerosene will continue being sold at Sh169.48.

This means that the government will burn the stabilisation fund to compensate oil marketing companies Sh7.33 for every litre of petrol sold, and Sh3.59 for diesel while consumers of kerosene will receive a Sh5.74 relief per litre from the kitty.

Total taxes per litre for petrol now accounts for 40 percent of total pump prices, including a Sh5.4 levy meant to mitigate against rising global prices and has been paid by consumers for the last three years but used sparing by the government.

To keep prices unchanged, the energy regulator cut oil marketers’ margins by up to half and plans to compensate them later.

Audit records showed that oil marketers had been paid Sh124 billion out of the Sh169.8 billion owed to them as a result of the previous stabilisation scheme with the balance set to be paid through bonds.

Another key factor that has led to rising product costs is the depreciating local currency, which has now shed 16 percent since the year began.