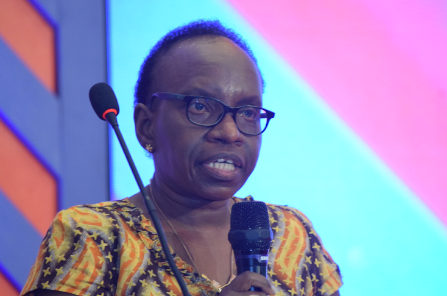

Kenya’s true debt position is unclear due to inconsistencies in records kept by the National Treasury and state agencies implementing projects with borrowed funds. According to a new report by Auditor General Nancy Gathungu, the National Treasury and implementing agencies do not share loan information, leading to potential inaccuracies in the reported debt.

The government has been paying billions for loans that are not ready to be spent. By the end of the financial year on June 30, 2023, a total of Sh55 billion had been paid for loans acquired before projects were ready to commence. Inadequate preparation by state agencies has resulted in unnecessary financial burdens on taxpayers, or funds that could have been used to address budget deficits.

A September 2022 report revealed that 14 loans exceeded preparation timelines, accruing Sh1 billion in commitment fees. In 2023 alone, 32 projects accrued Sh1.9 billion in commitment fees due to delays in project initiation. The report highlights that state agencies initiated loans before acquiring or compensating for land and before signing contracts, particularly in energy and road projects.

Auditor General Gathungu emphasized that such payments are avoidable with adequate preparation and timely project implementation by government agencies. She stated that “payment of avoidable fees compromises service delivery and value for money for taxpayers.”

These findings support concerns by reformists who recently demanded an audit of the country’s public debt. President Ruto’s financial adviser, David Ndii, noted that the Auditor General audits public debt annually.

As with former Auditor General Edward Ouko, the current office has flagged irregularities in debt management. The report, dated June 2024, concludes that inconsistencies between Treasury records and agency ledgers are significant.

A cursory look at the balances, as reported by the National Treasury and Central Bank of Kenya (CBK), reveals discrepancies in the country’s debt records.

The National Treasury reported the total public guaranteed debt stock as Sh10.420 trillion as of March 2024, while CBK stated it was Sh10.398 trillion.

The auditor’s records put the figure at Sh10.264 trillion as of June 30, 2023. An audit review of loans issued between 2010 and December 2021 also highlighted unexplained discrepancies between loan balances, indicative of a lack of periodic loan reconciliations.

The audit further revealed that loans are not exclusively being used for development, confirming suspicions that the government uses loans to fund recurrent expenses.

Auditor General Nancy Gathungu raised concerns about the lack of full disclosure regarding the total cost of loans, including additional fees such as interest due to late payments. This lack of transparency makes it difficult to establish the total cost implications of late payments.

In response to public pressure, President William Ruto appointed a task force last Friday to conduct a forensic audit of the public debt. However, the effort has been halted by a court order, delaying Kenyans’ ability to understand the actual state of public debt.

The Law Society of Kenya, represented by its president Faith Odhiambo, rejected its nomination to the task force. A petition before the High Court challenges the constitutionality of the task force, with petitioners Magare Gikenyi and Eliud Matindi securing court orders to halt the review. They argue that the office of the Auditor General, being independent and sufficient, should conduct the required review.

Gikenyi and Matindi claim that allowing the task force to proceed would be a “waste of scarce public resources.” Concerns about the transparency of debt transaction records have fueled doubt among Kenyans agitating for reforms and accountability regarding the amounts reported as paid and the outstanding debt. Auditor General Gathungu’s review highlighted the need for greater transparency in debt transactions.

“The National Treasury should ensure transparency while recording debt transactions for better understanding and making informed corrective decisions,” reads part of the auditor’s report.

This week, the auditor published eight reports on public debt, detailing various issues with the country’s loans. The reports reveal that state entities are not adequately adhering to loan due dates, exposing taxpayers to additional charges.

“Adherence to loan due dates was observed to be approximately below average as more than half of the payment advisories were processed after the loan due date,” the report states.

The reports also highlight a lack of clarity in the roles of the National Treasury, Controller of Budget (CoB), Central Bank of Kenya (CBK), and the Attorney General regarding the management of loans as they fall due.

Additionally, the auditor flagged an extra CBK charge of 1.5 percent on loans, which is not formally agreed upon and uniformly expressed across all functions. “This leads to inadequate transparency in debt operations,” the auditor noted, urging the Treasury, CoB, and CBK to establish service level agreements for processing repayments.

It was also found that the Treasury and state agencies lack measures to cancel loans for non-performing or stalled projects. The government faces criticism for delays in providing counterpart funding for loan-funded projects. Furthermore, the process of paying contractor claims is lengthy and cumbersome, creating liquidity challenges that slow project progress.

The auditors discovered that implementing agencies are scarcely involved in the pre-loaning process, making it difficult for them to prepare on time. Loan contracting operations were found to be inadequately managed, increasing the risks and costs of borrowing.

A performance audit indicated insufficient public participation during the identification of projects to be funded by loans. It emerged that financiers often approach ministries directly before projects are conceptualized by the users.

“Interviews further revealed that financiers indicate their intentions to finance selected projects from the ministries’ strategic plans,” a report published last October reads. The audit concluded that there are risks that the loans contracted may not be the most cost-effective in the market. Additionally, state agencies have been found to ignore the advisories of the Attorney General, leading to challenges with project implementation.