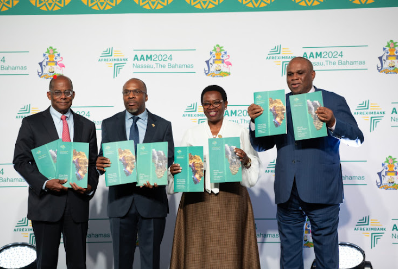

Afreximbank highlights debt as one of the major obstacles hindering Africa from reaching its full potential. According to its latest report titled “A Resilient Africa:

Delivering Growth in a Turbulent World,” the continent faces several challenges, including increasing levels of sovereign debt, sustainability risks, and vulnerability to adverse terms-of-trade shocks.

Other risks cited in the report include geopolitical tensions, volatile domestic political environments, high commodity prices, inflationary pressures, and potential food insecurity.

Despite these challenges, the report forecasts that African economies will grow by an average of 3.8 percent in 2024, slightly exceeding the projected global growth rate of 3.2 percent. It predicts that this growth will continue, reaching four percent in 2025.

The report also highlights the impact of ongoing global challenges on Africa’s trade performance. It states that Africa’s trade decreased by 6.3 percent in 2023, down from 15.9 percent in 2022.

However, there was a 3.2 percent expansion in intra-African trade during the same period, according to Afreximbank Group Chief Economist and Managing Director Yemi Kale.

“This performance is reflective of the resilience of the African economy and the potential impact of the African Continental Free Trade Area’s (AfCFTA) single market for the continent as a tool to protect them from global shocks,” Kale said.

“Our analysis in the report also revealed large untapped potential in intra-African trade, especially in machinery, electricity, motor vehicles, and food products,” he continued.

The outlook for the African Continent in 2024 remains positive despite the challenging economic environment of 2023, with most macroeconomic indicators expected to improve in 2024 and 2025.

Furthermore, growth across Africa is projected to exceed the global average.

Inflation, though currently high, is expected to trend downward over the coming two years.