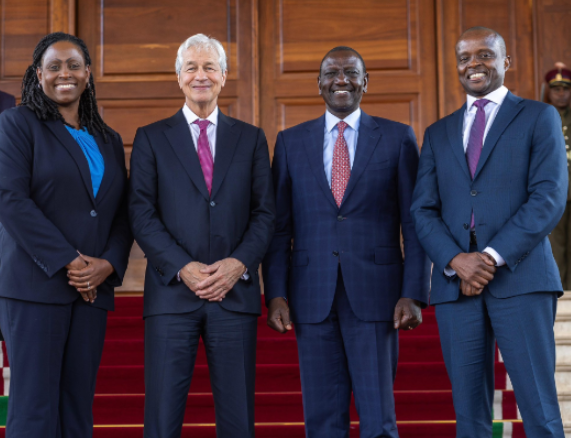

President William Ruto has clarified that the US finance giant JP Morgan will not be conducting banking activities in Kenya. This clarification followed a meeting with JP Morgan’s Chief Executive Officer, Jamie Dimon, at State House in Nairobi on Thursday, October 24, 2024.

Ruto stated, “JP Morgan, the world’s biggest bank by balance sheet, has received the approval of the Central Bank of Kenya to open a representative office in Nairobi. The office will serve as a liaison and marketing hub for JP Morgan and its subsidiaries. Though it will not engage in banking activities, it will explore business and investment opportunities in Kenya and the entire East African region. Kenya has tremendous appeal as a diversified and dynamic economy and has the potential of being JP Morgan’s financial centre in Eastern Africa,” as noted in a statement he posted on X.

In mid-October, the Central Bank of Kenya (CBK) granted JP Morgan permission to operate in the country. The CBK announced, “The Central Bank of Kenya (CBK) announces the granting of authority to JPMorgan Chase Bank N.A. of the United States of America to establish a Representative Office in Kenya by the name JPMorgan Chase Bank N.A. Representative Office Kenya.

This authority is granted pursuant to Section 43 of the Banking Act and follows the fulfillment, by JPMorgan Chase Bank N.A., of the stipulated authorisation requirements. Under the Banking Act, Representative Offices of foreign banks in Kenya serve as marketing and liaison offices for their parent banks and affiliates and are not permitted to undertake banking business.”

The CBK emphasized that JP Morgan Chase Bank will operate in compliance with this requirement. The bank, headquartered in New York, operates in over 60 countries worldwide, providing a range of services including asset and wealth management, commercial banking, investment banking, and financial technology.

In establishing a presence in Kenya, JP Morgan Chase Bank aims to explore business opportunities in both Kenya and the wider East African region. The representative office is expected to contribute to the diversity of Kenya’s financial sector and catalyze trade and investment. The CBK added that the authorization of the representative office reaffirms Kenya’s status as a premier financial services hub.