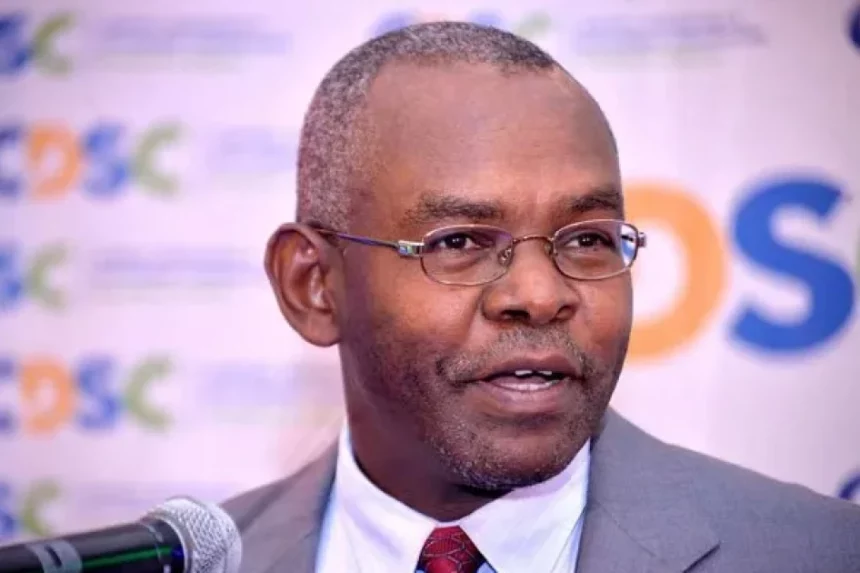

Central Bank of Kenya Governor Kamau Thugge was on Tuesday grilled by Parliament over the unprecedented depreciation of the shilling against the dollar.

As of Monday evening, CBK announced that the shilling was trading at Ksh.150 against the US dollar.

Thugge cited several issues but insisted that demand for the dollar has forced the devaluation of the Kenyan shilling.

“There is an excess demand for dollars. In August 2023, the supply exceeded the demand, and this is one of the structural issues to give a larger supply of dollars over time. In June -September, there was a slowdown in depreciation because of this increased supply,” he told the Parliamentary Finance and National Planning Committee.

The CBK Governor called for structural reforms to ensure that supply exceeds the demand sustainably.

“The rate cannot be reduced in a month; we need a continuous system that ensures sustainability,” he explained.

“Decline in international reserves caused overvaluation of the exchange rate. In 2022, the aggressive rise in interest rates was done to curb inflation. That affected the foreign exchange rate,” Thugge said.

He added that Kenya needs to invest in other forms of tourism to help with the flow of dollars into the country.

“We need to invest in Medical Tourism regionally to increase the flow of reserves and foreign reserves. In 2022-2023, Kenya had Ksh.1.3 billion in returns, with Tanzania making double in terms of travel receipts.”

Mr Thugge also called on Kenya to invest in direct foreign investments to attract foreign investors saying the country is attracting 1.7% of the GDP from foreign investments.

He further said there has been a reduction in imports into the country from 13.2% to 11.4%.

“Imports have reduced and the exports have increased. The exchange rate is meant to encourage exports and decrease imports,” said Thugge.

However, the governor said exports are projected to remain unchanged this year due to the foreign exchange, citing a slowdown of production in Europe, which also contributed to the slow exchange rate.

Thugge also mentioned that there will be a meeting with the International Monetary Fund (IMF) next week to discuss financial reforms and debt financing.

“We expect to get 400M dollars, how much we will get, I don’t know but it’s on the table. Expect Ksh.750 million from the World Bank by March next year. We have requested additional financing, an extra Ksh.530 million expected,” the CBK boss continued.

He was quick to clarify that the financing would not mean an increase in debt.

“It’s not borrowing but replacing expensive debt with affordable ones,” he continued.