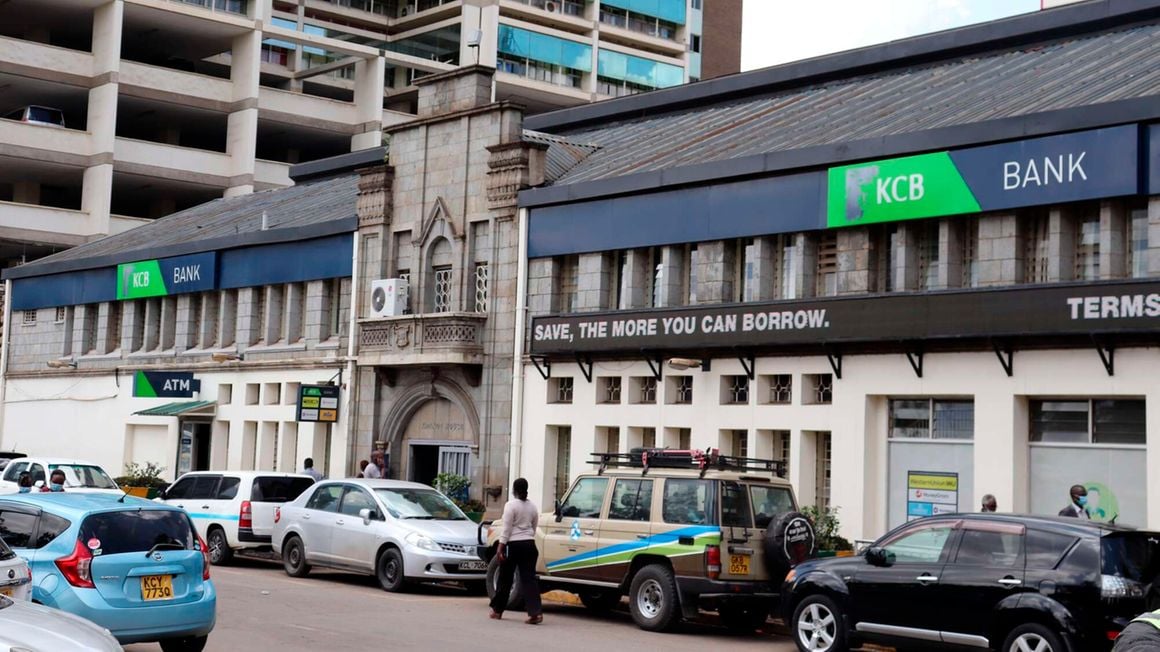

KCB Bank Kenya has entered a partnership with Swedish International Development Cooperation Agency (SIDA) to insure the lender against defaults of up to Sh1 billion as it seeks to expand its loan book to small and medium enterprises (SMEs).

The guaranteed line will be in place for seven years and is poised to strengthen KCB’s commitment to financing SMEs, which continue to experience operational hurdles, especially in regard to access to affordable credit.

In a statement, the parties said the agreement will help scale up lending activities to SMEs in situations where the target clients are unable to meet collateral threshold requirements.

“We are excited about this new instrument as it offers us the flexibility to work with SMEs and the refugee population in their ambitions and to support their entrepreneurial journey,” said KCB acting director of retail banking Michael Kung’u.

“The SME guarantee will therefore go a long way in diversifying the SMEs’ financing resources and reducing collateral requirements, thereby enabling them to play a leading role in achieving economic and social development.”

Risk-sharing facilities are increasingly emerging as key tools of supporting the closing of knowledge gaps by lenders, broadening their SME lending while at the same time mitigating risk and allowing them to build capabilities and track records in serving niche market segments.

On her part, Swedish Ambassador to Kenya Caroline Vicini said the cooperation aims to create opportunities for better living conditions for people living in poverty and under oppression.

“This initiative will enable Sweden’s engagement to go beyond the official development assistance and focus more on innovative financing approaches to mobilise domestic resources to reach the most vulnerable communities in Kenya,” said Vicini.

In the past months, the African Guarantee Fund (AGF) has been the most visible body signing similar deals with local lenders that include among others Absa, the National Bank of Kenya (NBK), Ecobank and Stanbic.