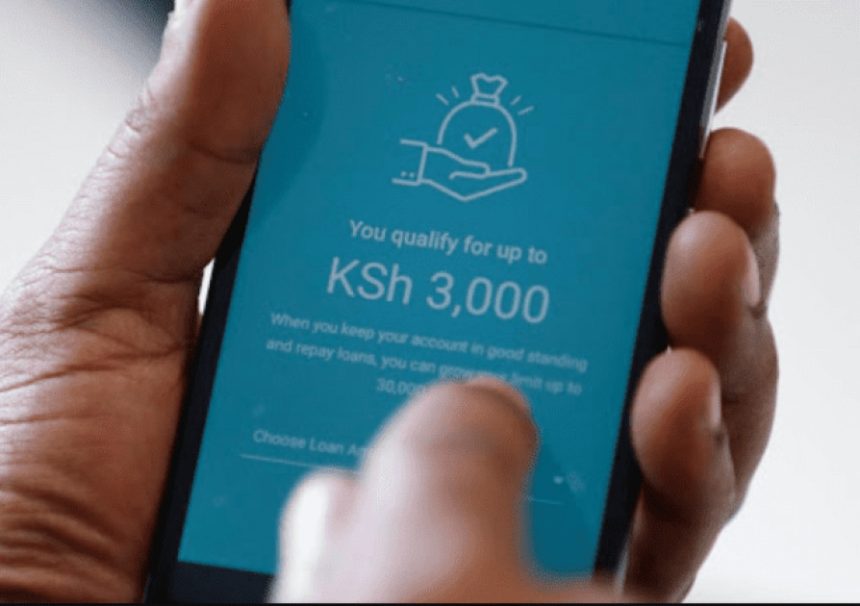

Kenyans are borrowing an average of Ksh.500 million daily, amounting to Ksh.15 billion monthly, a new report by the Digital Financial Services Association of Kenya (DFSAK), has revealed.

The report also highlights that over 8 million Kenyans, about 16% of the population, actively use digital lending services each month.

“The digital lending industry has become crucial for economic growth—attracting investment, creating jobs, and lifting millions out of poverty. The consumer protection improvements have been made, we used to have 4000 calls in 2019 of complaints now they have been reduced to a few dozen per month,” said DFSAK Chairman Kevin Mutiso.

DFSAK welcomed the Business Laws (Amendment) Act 2024, which took effect in January, placing digital credit providers under Central Bank of Kenya regulation, noting that it has strengthened consumer protection.

The association has already slashed consumer complaints from 4,000 a month to just a handful through the adoption of a stricter code of conduct. It is also working closely with the Office of the Data Protection Commissioner to establish further safeguards.

As the industry grows, the association is now pushing for tax reforms, particularly regarding bad debt allowances, to ensure sustainability.