The Old Mutual Group, in collaboration with the Kenya Institute of Curriculum Development (KICD), has launched an online financial literacy program aimed at junior and senior school teachers. This initiative was developed to integrate financial literacy education into existing curricula.

Under the current Competency-Based Curriculum (CBC), financial literacy is included in nearly all learning areas, spanning from pre-primary to senior school levels. Research has indicated that a significant portion of the Kenyan population lacks financial literacy, highlighting the need for consultative efforts to provide financial education from an early age.

Studies have also suggested that the ability to teach financial concepts can be enhanced through high-quality and engaging digital and non-digital content resources.

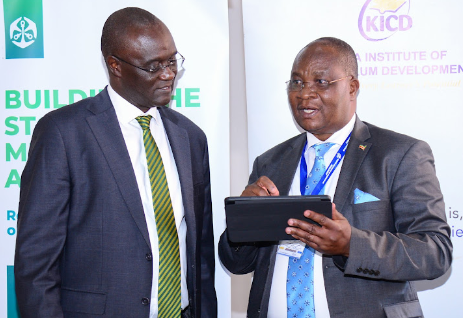

Prof. Charles Ong’ondo, the Chief Executive Officer of KICD, praised the Old Mutual Group for its commitment to societal transformation, particularly through investments in education. He noted that the initiative was launched after a successful pilot program involving 120 Junior Secondary School teachers from 36 schools across five counties: Uasin Gishu, Makueni, Laikipia, Siaya, and Kiambu.

“The learning gaps identified during our pilot informed the extent to which financial literacy could be integrated into other learning areas,” Ong’ondo explained. He expressed gratitude to Old Mutual and other partners for their collaboration in promoting financial literacy among Kenyans.

Mr. Arthur Oginga, CEO of Old Mutual Group, emphasized the importance of equipping Kenyans with financial management skills to foster the country’s growth and development. “We are ready to collaborate with all relevant partners to cultivate a generation of financially savvy individuals,” Oginga stated.

He further asserted that teaching financial literacy in schools is no longer optional but essential for providing students with the knowledge necessary for a successful future.

Old Mutual has invested an initial Sh25 million in the program, achieving several key milestones, including the development of integration matrices and guidelines in 2021, online orientation courses for financial literacy teachers in 2022, and the pilot program in 2023, along with a financial literacy toolkit for learners set to launch in 2024.

The online program is now accessible to all junior school teachers, with senior secondary school teachers expected to be onboarded starting in 2026. It is hosted on the Elimika platform, a cloud-based training portal that allows teachers to develop their skills through capacity-building courses on various topics.

Prof. Ong’ondo stated that this online platform will enhance the effective delivery of the curriculum regarding financial matters. “We are, therefore, delighted to launch the online program, which will enable teachers across Kenya to quickly integrate financial literacy elements into their teaching,” he said.

Oginga noted that the program’s launch aligns with Old Mutual’s community investment strategy, which emphasizes financial education, skills, and literacy initiatives, including financial awareness and education programs.

Additionally, Old Mutual is offering the Lengo Education plan, a long-term savings product that also provides life coverage during its term. This product aims to meet clients’ long-term savings needs while offering financial relief, allowing 15 percent of the savings to be accessible for emergencies.

The plan includes life cover equivalent to the total future gross premiums, with a free cover limit of Sh1.2 million. Furthermore, policyholders are eligible for a tax relief of 15 percent on their premiums and can use the policy as collateral for loans.