Kenya’s super-rich individuals and firms that knowingly make false declarations of income resulting in lower taxes face a steep jump in penalties in proposed changes to the law.

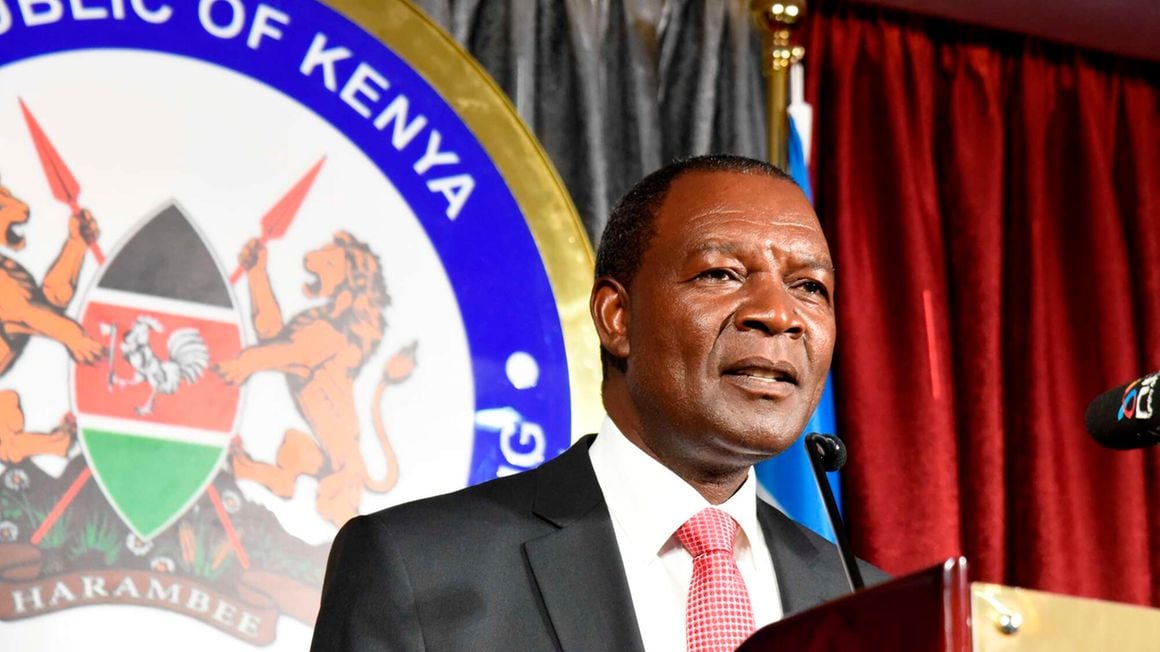

Treasury Cabinet Secretary Njuguna Ndung’u wants the penalties for tax evasion raised more than one-and-a-half times in a move that aims to help seal leakages.

The proposed changes to the Tax Procedures Act, through the Finance Bill 2023, will see the tax shortfall penalty surge from the current rate of 75 percent.

“Section 84 of the Tax Procedures Act, 2015, is amended in subsection (2)(a) by deleting the words ‘seventy-five per cent’ and substituting therefor the words ‘double the amount’,” the Finance Bill states.

The penalty for a firm or individual who made a false declaration resulting in a tax shortfall of Sh1 million, for example, will surge to Sh2 million from Sh750,000 if the amendments are approved. This is a 167 percent jump.

The punitive fines are aimed at helping the William Ruto administration discourage tax evasion and raise an additional Sh392.7 billion to fund Sh3.6 trillion in its first full fiscal year in office starting July.

The penalty will be cut by 10 percent if the guilty firm or individual voluntarily discloses the false statement or the omission to the Kenya Revenue Authority (KRA).

The amount rises by 10 percent for second-time offenders and 25 percent for third-time offenders as is the case at present.

The increased fines have come at a time the KRA suggested that nine in 10 companies did not pay taxes on their profit for the last financial year.

The taxman in an earlier report to the Business Daily said that out of 759,164 firms registered for corporation tax for the year ended June 2022, a modest 84,428 companies paid the dues — a compliance rate of 11.12 percent.

“A compliant taxpayer is a company which registers for the relevant tax obligations if/when they meet the registration requirement, files all returns on time, makes payments of taxes due on time and reports accurate information regarding their business transactions,” the then commissioner for Domestic Taxes Department, and now acting commissioner-general, Rispah Simiyu said last year via email.

Kenyan firms have in recent years battled rising operating expenses that climbed to levels never witnessed at least in eight years, findings of the monthly Stanbic Bank Kenya’s Purchasing Managers Index (PMI) suggest.

The high business costs are largely due to elevated energy expenses, costly raw materials, weakening shilling against major international currencies in a net import country and taxation pressures which have hit profitability.

“[The Treasury plans] to support mobilisation of tax revenue through leveraging on automation of systems for all key government entities, integration of KRA tax systems with critical government systems to allow seamless exchange of information for a 360-degree view of the taxpayers’ economic transactions and enhancement of the KRA capacity on big data analytics to drive compliance interventions,” Prof Ndung’u wrote in budget papers for the year starting July.