President William Ruto’s administration has lined up a new set of taxes, including a road tax, to be introduced in October should the High Court block the Finance Act, of 2023.

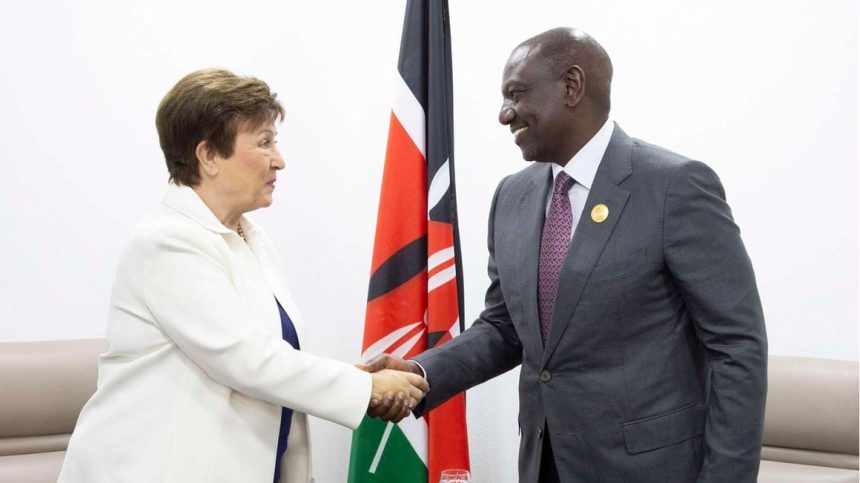

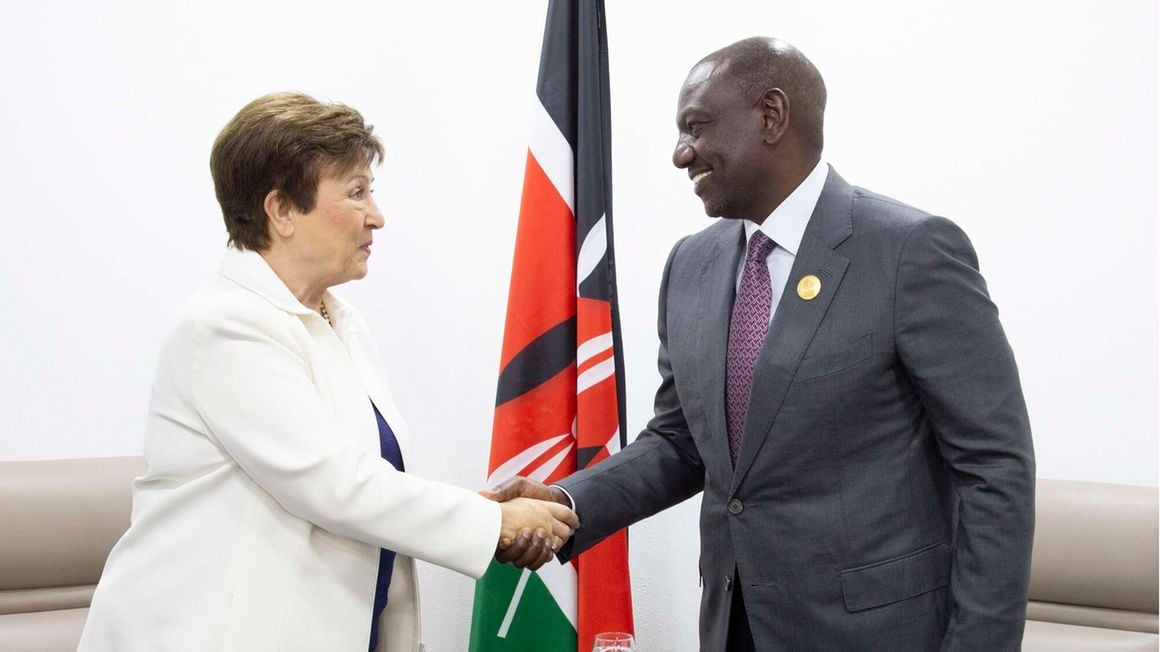

In disclosures to the International Monetary Fund (IMF), the Treasury has revealed that it is plotting the fresh taxes, including a motor vehicle circulation tax, excise and value-added tax (VAT) measures, in a contingency plan to fund the Sh3.68 trillion budget should the now suspended tax-raising measures hit a snag in court.

A motor vehicle circulation tax is a form of road tax paid by motorists to use public roads.

It can be calculated based on several factors, including the value of the vehicle, the engine and seating capacities.

The Treasury has committed to submit to Parliament “a package of legislative changes” by the end of October to ensure the government hits the Sh2.57 trillion ordinary revenue target in the current financial year and avoid falling further into debt.

“The authorities stand ready to adopt contingency plans that could include new excise and value-added tax (VAT) measures. They intend to submit to Parliament these contingency measures by end-October 2023 to support confidence in fiscal consolidation and the continued reduction of Kenya’s debt vulnerabilities,” says the IMF.

“Any tax revenue shortfall relative to programme targets will be compensated for by taking additional tax policy measures”.

The changes, the Treasury says, will include but are not limited to the adoption of a motor vehicle circulation tax and the reduction of tax exemption on interest income.

The measures, the Treasury adds, could include streamlining the VAT apportionment ratio of allowable inputs VAT on exempt supplies to align it with international practices and reducing VAT exemptions by the end of this month.

The Treasury’s promise to the IMF could mean Kenyans will not have an escape route from the looming tax pain that includes a doubled VAT on fuel at 16 percent.

Excise and VAT are consumption taxes, meaning they will hit even more taxpayers.

Ordinary revenue accounted for 71.9 percent of Kenya’s budget in 2011/12 but this has been on a decline.

Taxes funded just 56.8 percent of the 2021/22 budget, forcing the government to turn to more debt.

Kenya’s debt stood at Sh9.63 trillion in April.

The disclosures come against the backdrop of a new wave of street protests over the high cost of living and unpopular taxes that disrupted business activities in major towns in Kenya, including Nairobi, Kisumu, Kisii, Nakuru and Mombasa.

The IMF has asked the Ruto administration to stick to its taxation measures and not be moved by the street protests.

The lender, in the document made public on Wednesday when the new wave of protests started, classifies the likelihood of political risk as ‘medium’ and also notes that in the case the risk crystallises, the impact on the economy will be ‘medium.’

“Unrest could reemerge in connection with protests against the higher cost of living, need to raise more taxes and electoral process supported by the political opposition,” says the IMF, adding that the policy response by the government should be to “remain committed to reforms under the program.”

The Kenya Revenue Authority (KRA) last week said it had raised Sh2.166 trillion in the financial year ended June against a target of Sh2.273 trillion, translating to a Sh107 billion shortfall.

This could tempt the Treasury to come up with tax measures to enhance the chances of the taxman hitting the target in the current financial year.

The IMF says in its latest review that Kenya has met the conditions that warranted approving about $1 billion (Sh141.8 billion) financing and should not compromise on the agreed stance that includes the removal of subsidies and rolling out new taxes to cut the country’s reliance on debt.

Kenya got a $415 million (Sh58.8 billion) disbursement under the extended fund facility and expanded credit facility, programmes designed to support the economy and also boost its foreign exchange reserves.

The IMF fifth review also gave Kenya $551 million (Sh78.13 billion) as part of the resilience of a 20-month arrangement under the resilience and sustainability facility.

IMF disclosures reflect the stance that has been taken by the Kenya Kwanza administration, which has vowed to go ahead with its taxation measures such as a 1.5 percent housing levy on workers’ gross pay and the doubling of valued added tax on petroleum products to 16 percent, as contained in the now suspended Finance Act 2023.

The suspended Act also increased the turnover tax on small and medium enterprises from one percent to three percent and introduced a digital asset tax.

The High Court last month suspended the implementation of the Finance Act and referred the matter to the Chief Justice but the Energy and Petroleum Regulatory Authority (Epra) disregarded this and applied a 16 percent VAT in its review of prices.

Chief Justice Martha Koome has appointed a three-judge bench to hear the case challenging the implementation of the Finance Act, 2023.

Busia Senator Okiya Omtatah, who filed one of the petitions against the Finance Act, has applied to have the energy regulator cited for contempt of court.