President William Ruto’s government will borrow at least Sh718 billion in the financial year starting July, even as he faces a heavy debt service burden during the year.

Treasury Cabinet Secretary Njuguna Ndung’u, yesterday said the government projects to raise Sh2.96 trillion in total revenues and spend Sh3.7 trillion during the 2023/24 financial year, leaving a budget deficit of Sh718 billion that will be filled through domestic and external borrowing.

“Given the projected revenue and grants against the projected expenditures, the fiscal deficit is projected to decline to Sh718 billion (4.4 per cent of GDP), from Sh840.9 billion (5.8 per cent of GDP) in 2022/23. The fiscal deficit will be financed through net external financing of Sh131.5 billion and net domestic financing of Sh586.5 billion,” Prof Ndung’u stated while delivering the Kenya Kwanza government’s maiden budget.

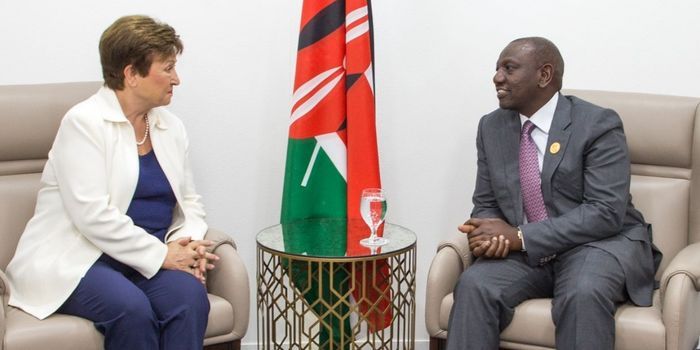

The CS said the government was relying on the support of multinational organisations including the World Bank and International Monetary Fund (IMF) to achieve fiscal consolidation that would see it cut the fiscal deficit from the current 5.8 per cent, 4.4 per cent in 2023/24, down to 3.6 per cent by 2026/27.

The government plans an aggressive revenue mobilization strategy by hunting more taxes from Kenyans, as a way to avoid much borrowing.

While insisting that Kenya’s public debt remains sustainable, the CS, however, observed that it is with “elevated risks of debt distress due to persistent global shocks that adversely affect the liquidity ratios.”

Treasury appreciates that the depreciation of the Kenyan Shilling against major foreign currencies has not only raised the cost of external debt service but raised the external public debt stocks.

“External debt service is projected to increase to Sh475.6 billion in 2023/24 from Sh242.1 billion in 2022/23 mainly reflecting redemption of the $2 billion Eurobond. In preparation for the redemption of this maturing bond, Treasury issued an expression of interest to bring on board a lead manager to advise the government on liability management options towards the resolution of the Eurobond 2024,” the CS said.

Public debt

Kenya’s public debt hit Sh9.29 trillion in March according to the latest release by Treasury, even as debt service raised by Sh179 billion in the nine months to March, according to the Controller of Budget (COB).

“Domestic debt stock was Sh4.539 trillion (31.3 per cent of GDP), while the external debt stock was Sh4.85 trillion (33.4 per cent of GDP). Domestic and external debt stock accounted for 48.3 per cent and 51.7 per cent of total debt stock, respectively,” Treasury stated in the March 2023 public debt bulletin.

On the other hand, the COB observed that between July 2022 and March this year, “total expenditure on public debt amounted to Sh831.03 billion, compared to Sh651.73 billion recorded in a similar period FY 2021/22.”

The government spent Sh393 billion settling principal debts and Sh436.6 billion on interest payments, mainly on domestic loans.

“Public debt expenditure comprised of external debt of Sh302.56 billion and domestic debt of Sh528.47 billion. External debt servicing comprised Sh186.84 billion for principal payments, Sh114.50 billion for interest payments, Sh1.07 billion for commitment fees, and Sh156.09 million for other charges.

“The total domestic debt payment consisted of Sh206.33 billion and Sh322.14 billion for principal and interest payments, respectively,” the COB stated in its report on the national government’s budget implementation review report for the period running July 2022 to March.

Prof Ndung’u also indicated that pending bills in the government have continued to grow, noting that Treasury has drawn a cabinet memo requesting the cabinet to approve the establishment of a pending bills verification committee to carry out an analysis of the stock of all pending bills and advise on how they will be settled.

The national government’s pending bills totalled Sh537.2 billion by the end of March 2023, while counties totalled Sh159.7 billion.

“The management of pending Bills is a challenge. In the public eye, it will form an important benchmark upon which the overall integrity of the government’s style of financial management will be tested and judged. The delay in settling payments of pending bills has led to the deterioration of financial positions of businesses in particular MSMEs, including businesses owned by women, youth and PWDs,” the CS said.

The Controller of Budget (COB) in the national government’s budget implementation review report for the nine months to March also warned that the pending bills continue to affect business in the country.

“Pending bills affect business liquidity and deny government revenue in taxes. The Controller of Budget recommends that National and County governments prioritise payment of the pending bills by settling them as a first charge in the current financial year budget in line with the Treasury Circular No. 04/2022,” the COB stated.