The government will hand more than 100 fuel stations owned by the National Oil Corporation of Kenya to a private investor in a rescue deal aimed at shielding it from collapse.

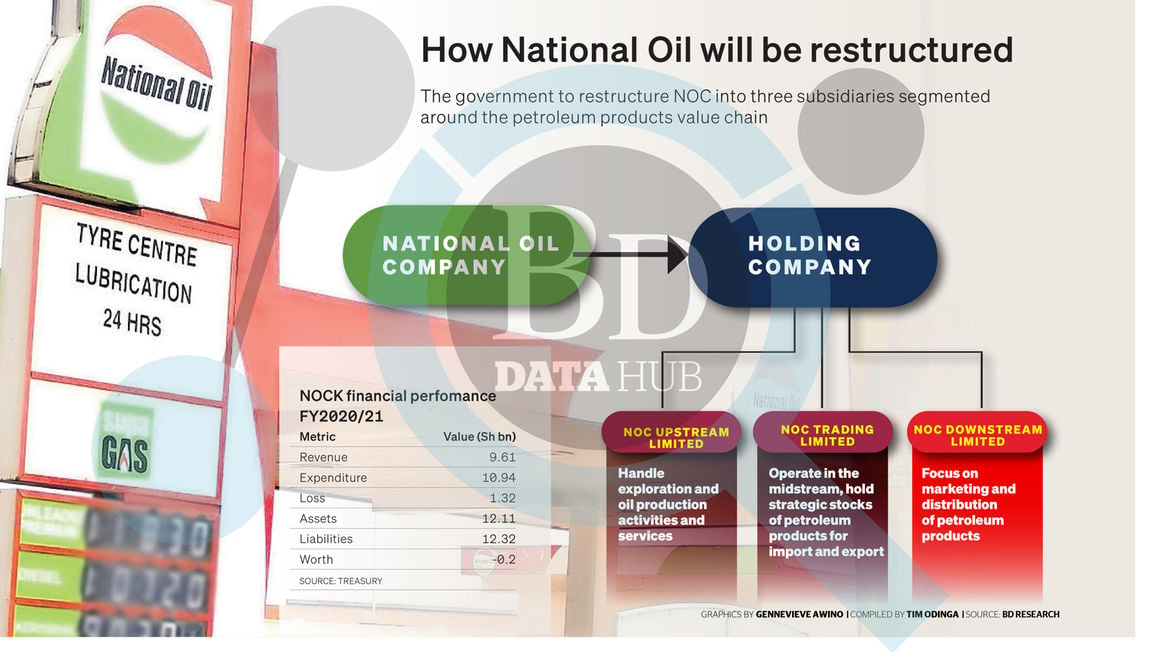

The move is part of a restructuring process that will see the State-owned parastatal, popularly known as National Oil, split into three subsidiaries, under one holding company.

The government will then hold onto the strategic assets through two subsidiaries but allow the downstream market entity, which will control the fuel stations, to be run profitably by a private investor.

The profits from the entity will then be split with the deep-pocketed investor, who will be sourced from licensed oil marketers locally and abroad.

“Nock is Sh8.3 billion in debt and has a negative balance sheet. At the moment, it cannot even pay salaries and it cannot get new loans. Unless we go that route, then it will not survive,” Energy Cabinet Secretary Davis Chirchir told the Business Daily in a phone interview.

“Currently, it is impossible for National Oil to compete in the open tender system. The strategic non-equity investor will inject working capital and deal with branding to make the brand more visible in the market. Then profits will be shared at the end. National Oil has more than 100 fuel stations and at times you will find that more than 20 do not have the product. We are looking at this like a supermarket where one brings their product and it is sold at the stations.”

However, the investor will not own shares in the company.

As part of the plan, the Cabinet on Tuesday approved the conversion of National Oil into a group holding company with three distinct subsidiaries, including NOC Upstream Limited to handle exploration and upstream production activities and services.

NOC Trading Limited will operate in the midstream, specialising in holding strategic stocks of petroleum products for import and export while NOC Downstream Limited will focus on marketing and distribution of petroleum products.

“The transformative actions strengthen Kenya’s socio-economic fabric by fostering inter-generational equity through an improved framework for social protection coupled with the revival of State corporations within agriculture, petroleum and energy sectors,” the Cabinet dispatch said.

At present, National Oil is a fully integrated State corporation involved in all aspects of the petroleum supply chain as a single unit.

“Each subsidiary will be focusing on a core mandate. Upstream deals with the exploration of oil and gas which consist of multi-year capital-intensive projects. It is also the vehicle that holds back in rights or carries interest in international oil companies (IOCs) operated exploration blocks like in Lokichar/Turkana oil,” National Oil CEO Leparan Morintat told the Business Daily on Tuesday

Currently, it has an oil exploration block (Block 14T) that runs from the shores of Lake Bogoria to the Lake Magadi basin.

The trading unit is meanwhile expected to run the importation of petroleum products, exports and management of the country’s strategic petroleum reserves.

The non-equity strategic partner in the fuel marketing business would also be expected to provide expenditures to address financial and operational challenges.

By adopting a new structure, Mr Morintat said National Oil would take the form of other State corporations that have distinct operating units.

“Other State-owned companies that have subsidiaries include Kenya Seed Company which has Simlaw Seeds Kenya, Simlaw Seeds Uganda and Simlaw Seeds Tanzania as wholly owned subsidiaries,” he added.

The Treasury, as National Oil’s main shareholder, is expected to mediate discussions with lenders on the settlement and treatment of arrears accruing to the company which mostly cover interest and penalties.

The discussions will be pivotal in freeing up the company from the shackles of banks.

KCB, for instance, has attached to the company’s assets over debts in excess of Sh4.8 billion.

National Oil is in a precarious financial situation, with its current liabilities for the year ended June 2021 having exceeded current assets by Sh6.3 billion, leaving it technically insolvent.

The State corporation’s accumulated losses at the end of the period stood at Sh4 billion after returning a net loss of Sh1.32 billion.

Data from the Treasury covering the same period show that National Oil’s total liabilities stood at Sh12.32 billion against Sh12.11 billion in assets, leaving the company in a negative valuation.

The investor will also streamline the operations of the entity and deal with audit queries beyond its financial footing which saw it receive a qualified opinion from the Office of the Auditor-General.

In her audit of the firm’s books for the 12 months to June 2021, Auditor-General Nancy Gathungu flagged 10 audit matters, including inaccuracies in bank and cash balances, a decline in the value of freehold land and unsupported provisions in inventories balance, inaccuracies in trade and other receivables and unsupported deferred income

Other audit queries were on inaccuracies in trade payables, unsupported funds, inaccuracies in staff costs, errors in exploration and operating expenses and payment of unspecified allowances.

Additionally, the State corporation had not met the petroleum strategic stock equivalent to at least 90 days of supply for jet fuel, petrol, diesel, kerosene and LPG.

It had also not filed annual returns since 2018.

The State corporation became operational in 1984, with initial operations limited to exploration activities before going downstream four years later when it started participating in the importation and sale of petroleum products.

In its heyday, it had a retail footprint of 110 service stations that included 13 stations acquired from BP in 2009 and 33 stations acquired from Smoken in 2010.

In December 2020 its share of local sales volumes of petroleum products stood at 1.6 percent before falling below 0.7 percent at the end of last year.