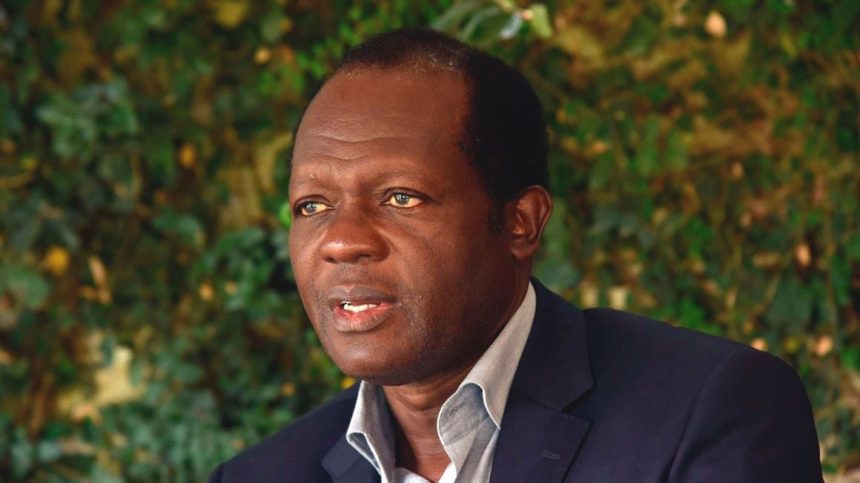

Former Jubilee Party secretary-general Raphael Tuju faces auction over a botched loan deal with a regional bank after the Court of Appeal dismissed his bid to block enforcement of a judgment by a UK court in 2019.

The appellate court cleared the way for East African Development Bank (EADB) to recover the $9.3 million loaned to Mr Tuju on July 31, 2015, which has since ballooned to over $16.5 million (Sh2.22 billion).

At stake is a 20-acre prime property in Karen worth over Sh1.3 billion and a high-end hotel, Dari Restaurant, associated with the Tujus.

EADB, which is partially owned by the Kenyan government, was locked in a four-year legal battle with the former Cabinet Secretary over the enforcement of a UK judgment to seize Mr Tuju’s property under Dari Limited for sale.

Mr Tuju unsuccessfully fought the enforcement of the UK judgment up to the Court of Appeal, arguing that EADB was frustrating efforts to have other lenders, including KCB Group and equity investors, from making the property profitable.

“Ultimately, we are satisfied that this appeal has no merit. Accordingly, this appeal is hereby dismissed with costs to the respondent [EADB],” Justices Kathurima M’Inoti, Imaana Laibuta and Mwaniki Gachoka ruled on Thursday.

The judges said Mr Tuju and EADB voluntarily chose to subject themselves to the laws of England and the judgment cannot be set aside merely on the grounds that it was erroneous because it will constitute an appeal in disguise.

“It is therefore to be expected that before they make the choice of where their disputes will be resolved, they fully appreciate and understand the applicable law,” the judges said.

According to the judges, complaining that the laws are oppressive after a judgment is an ‘illegitimate attempt to renegotiate’ the applicable law after the fact.

“All this leads us to the conclusion that the purpose of sections 10(2) and (3) of the Act is not to provide a backdoor through which an unsuccessful litigant in the reciprocating foreign State can re-agitate his case in Kenya,” the court said.

Mr Tuju, who served as a Cabinet minister in the former administrations of Mwai Kibaki and Uhuru Kenyatta, was a prominent member of opposition leader Raila Odinga’s presidential campaign in the race won by President William Ruto last year. Mr Odinga disputed Dr Ruto’s victory, but the country’s Supreme Court upheld it.

Mr Tuju had obtained temporary orders in 2020 barring EADB from auctioning his property and proceeding with a bankruptcy case against him.

He has also filed another pending case before the Arusha-based East African Court of Justice.

EADB says the debt, which it advanced on July 31, 2015, at $9.19 million (then Sh932.7m), has remained in default since 2017 when it fell due.

The loans were for the construction of Sh100 million two-storey, flat-roofed bungalows sitting on a 20-acre forested land dubbed Entim Sidai and the purchase of a 94-year-old bungalow built by a Scottish missionary, Dr Albert Patterson, which currently operates as a high-end restaurant.

The London court dismissed Dari’s opposition to the bank’s claim, setting the stage for the lender to seek enforcement and auction.

The London court’s documents showed that the restaurant had entered into an agreement with the bank on April 10, 2015, under which it agreed to give Dari a $9.3 million (then Sh943.9 million) loan.

The deal gave the restaurant a 24-month grace period, which fell due in 2017.

But two years later, Dari had failed to pay $1.8 million (Sh243 million) in interest owed, according to the bank, adding that Mr Tuju had ignored a notice to clear the debt.

Among the accusations the defendants — who include the former Cabinet Secretary’s children Mano Tuju, Alma Tuju and Yma Tuju– faced were a breach of agreement and defaulting on the loan repayment.

EADB accused Dari, where Mr Tuju and his children are directors, of breaching the debt agreement and defaulting on the loan.

The London court also dismissed Dari’s counterclaim, which stated that the interest rate charged by the bank was a penalty that was not unenforceable.

The judge disagreed, ruling that it was a standard clause in loan agreements of the type advanced to the hotel.

Mr Tuju opted to fight his battles in the Kenyan court and accused EADB of breaching the terms of the loan deal, which made it difficult to complete the high-end real estate project.

First, he accused EADB of disbursing Sh932.7 million instead of the agreed Sh943.9 million, adding that the bank had reneged on the plan to offer Sh294 million for building luxury homes for sale.

The bank directly paid Sh932.7 million to the owner of the 94-year-old bungalow sitting on 20 acres and demanded that Mr Tuju provide additional security for the construction of the Sh100 million bungalows.

“Having failed to disburse the balance of $102, 916 (then Sh10.4 million) and further Sh294 million, the first defendant inevitably experienced cash flow challenges,” said Mr Tuju.

“EADB is fully aware that in the absence of the development of the housing units for sale as envisaged in the project proposal, Dari would not be able to service the loan facility.”