President William Ruto on Monday ordered all persons currently at Mumias Sugar Company to vacate and withdraw all court cases pertaining to it.

“We are ordering all to vacate the premises, that company belongs to the people. We shall make new plans for it and not entertain any court cases, they must withdraw them all. I have told them that the issues are three: if they attempt to bring problems they shall have to leave the country, get into prison or travel to heaven,” warned the President.

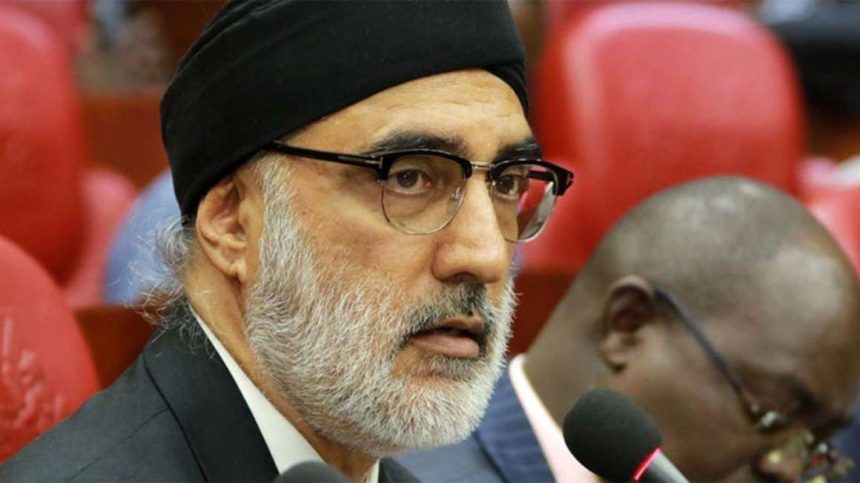

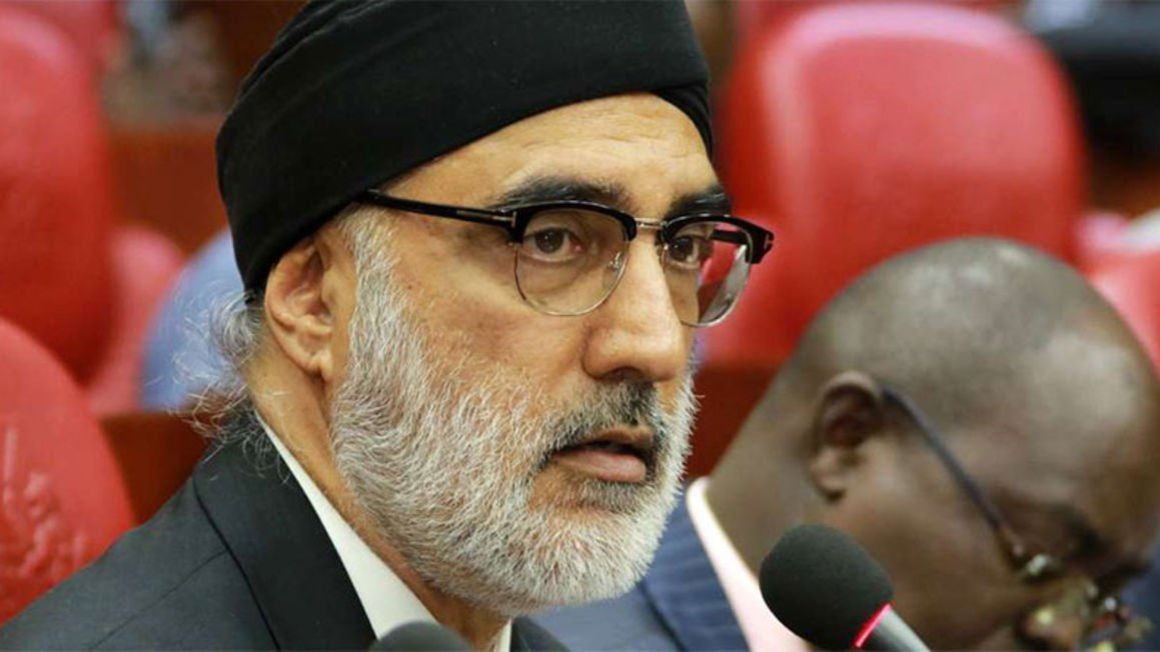

At the same time, Kabras Sugar boss Jaswant Singh Rai yesterday refused to comment on his “abduction” on Friday last week, opting instead to go about his business as he was spotted leaving his Kilimani home.

In his last communication with the Nation, his lawyer Senior Counsel Kioko Kilukumi said he was waiting to meet his client physically before issuing a statement on his condition and abduction, but this had not happened by the time of going to press.

“I have not met him physically, we have only spoken on the phone. I am waiting for his call to persuade him to tell me who the people are who are holding him, where they are holding him and why,” he said.

The embattled billionaire was released by his abductors on Sunday evening, two days after he was kidnapped in Kilimani in what has now been firmly linked to his dealings with Mumias Sugar Company Limited.

Detectives from the Economic Crimes Unit are investigating his alleged involvement in fraud, particularly money laundering and tax evasion, in the buy-out of some of the ailing sugar company’s creditors by a company linked to him.

According to an affidavit filed in court in January by Dr Julius Monzi Muia, the Principal Secretary to the National Treasury, Mumias’ company’s last audited accounts as at June 30, 2018 show that the company was declared insolvent when its liabilities exceeded its assets by Sh21.4 billion.

Total borrowings, principal loans and interest from banks, government institutions and others stood at Sh12.59 billion.

The company owed the National Treasury Sh3.124 billion, Eco Bank Kenya Sh2.08 billion and France-based PROPARCO Sh1.96 billion. Kenya Sugar Board Sh1.68 billion, KCB Sh545.5 million, Commercial Bank of Africa Sh401.3 million and KCB overdrafts of Sh2.796 million.

PROPARCO’s loan was secured by a fixed charge over the assets of the co-generation plant, while Eco-bank’s loan was secured by a pari passu first ranking specific debenture in favour of the syndicate lenders over the ethanol plant, ethanol receivables and ethanol inventory up to $20m.

The affidavit adds that KCB’s overdraft facility and term loan were secured by a Sh2.47 billion debenture over the company’s assets ranking pari passu with Absa Bank and Stanbic Bank and a legal charge of Sh2.43 billion over Mumias’ land LR No. Mumias sugar scheme/2 in Kakamega.

The government’s financial support through the Sugar Board/Commodity Fund and National Treasury totalling Sh4.81 billion (principal and interest) was unsecured and no loan agreement was entered into. The company remains in default of principal repayments on the loan facilities to date.

However, in September 2019, the secured lenders placed the company under receivership and appointed Ponangipalli Venkata Ramana Rao as receiver.

In an attempt to revive the collapsed miller, the government leased the company to Ugandan conglomerate Sarrai Group after a bidding process that lasted about four months.

But before the company could turn around the miller’s fortunes, a lawyer claiming to be one of the miller’s creditors sought to liquidate the miller over an alleged debt of Sh76 million for representing the company since 2015.

Around the same time, Dubai-based Vartox Resource Inc, through Victoria Commercial Bank Republic Limited Company, approached the banks, bought their interest in the loans and joined the case as a creditor.

Last year, Justice Alfred Mabeya cancelled the lease granted to the Sarrai Group, saying it would “remain an asset of KCB in perpetuity and a retirement home for Mr Rao – the receiver”.

The DCI is investigating possible money laundering in Vartox’s involvement.

Yesterday, detectives from the Economic Crimes Unit questioned Victoria Commercial Bank CEO Yogesh Pattni for hours at the Directorate of Criminal Investigations headquarters, trying to establish the source of the money that bought out the loan interest and whether tax was paid on it.

“We are not involved in the insolvency matter, we are investigating possible criminal money laundering and tax evasion,” an official privy to the matter told the Nation.

Officials believe that Rai is using proxies to frustrate the revival of the sugar company and have recorded statements from 28 persons of interest, including the recently appointed receiver, Mr Harveen Gadhoke, who told detectives that he was appointed without his authority.