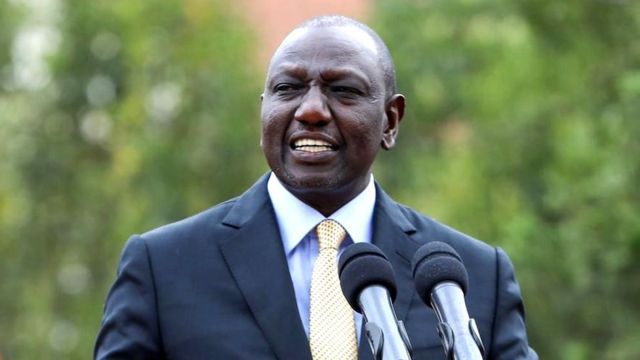

President William Ruto’s administration has increased the budget for the day-to-day running of the national government by Sh87.57 billion as his administration reorganises the budget plan inherited from the Uhuru administration.

Recurrent expenditure for this financial year ending June has been revised to Sh1.27 trillion from the previous cap of Sh1.18 trillion set by the former regime, official data published on Friday by Treasury secretary Njuguna Ndung’u shows.

The revised expenditure estimates follow the approval and signing into law of the supplementary budget earlier in the month.

The increased budget on administration, operation and maintenance as well as salaries and wages comes months after Dr Ruto pledged to cut the recurrent budget as much as Sh300 billion to bring “our country to sanity” where the State does not borrow to “finance recurrent expenditure”.

His administration has, however, maintained it inherited Sh279.26 billion in non-debt payments which were either carried over from the previous financial year ended June 2022 or unbudgeted like the Sh20 billion Hustler Fund.

The carried-over obligations, the Treasury told the International Monetary Fund (IMF) in their last routine review meeting, have piled pressure on government expenditures, slowing down the implementation of the fiscal consolidation programme.

Non-debt payments amounting to Sh88.66 billion were deferred from last financial year, while Sh61.02 billion bills which were incurred earlier this fiscal year — including Sh26.09 billion for fuel, maize flour and fertiliser subsidies ahead of the hotly-contested August presidential poll— were not in the budget.

“Remaining pressures [Sh130 billion] are mainly related to the July and August pause in fuel price adjustments, July’s temporary introduction of a maize flour subsidy, unavoidable drought emergency interventions, and the launch of new initiatives from our administration, including plans to support agricultural production by subsidising fertiliser,” Prof Ndung’u said in the letter to the IMF, which he wrote jointly with Central Bank of Kenya Governor Patrick Njoroge.

The revised Treasury data shows the target for the Kenya Revenue Authority has been raised by Sh36.4 billion to Sh2.11 trillion amid Dr Ruto’s directive to the taxman to “collect every shilling due”.

Additional cash is expected to come from savings from capital projects whose budget, excluding grants from development partners, has been trimmed by Sh30.58 billion to Sh398.81 billion.