The concerns raised by the Kenya Bankers Association (KBA) regarding the Finance Bill 2024 highlight potential challenges that could arise if the proposed amendments are implemented without modifications.

Chief among these concerns is the possibility of a significant number of individuals and businesses opting out of formal banking systems due to increased transaction fees.

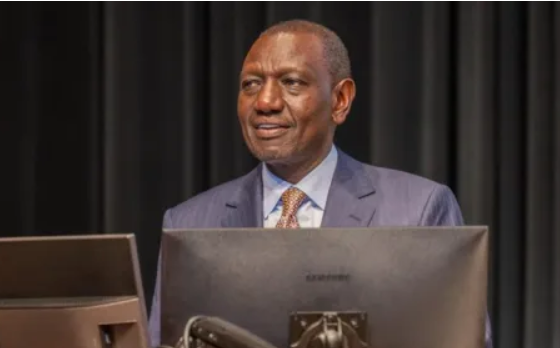

Raimond Molenje, the CEO of KBA, emphasized that the Bill’s proposals, particularly the increase in excise duty and Value Added Tax (VAT), would directly impact transaction costs for customers.

With the proposed increase in excise duty from 15% to 20% and the introduction of additional VAT, there is a projected 25% rise in transaction fees.

Such a scenario could deter people and businesses from conducting transactions through formal banking channels, leading to a potential shift towards informal or alternative financial services.

This exodus from the formal banking sector could have far-reaching implications for financial inclusion efforts and the stability of the banking sector in Kenya.

It’s crucial for policymakers to consider these concerns and evaluate the potential impact of the proposed amendments on financial accessibility, affordability, and inclusion.

Balancing the need for revenue generation with the objective of fostering a conducive environment for financial inclusion and economic growth will be essential in shaping the final version of the Finance Bill 2024.

“There is a 25 per cent increase and this just makes transactions very difficult and unfortunately people are forced to move out of the formal banks and mobile bankings,” Molenje stated.

Raimond Molenje: Financial inclusion means individuals and businesses being able to access financial services easily, affordably and with dignity. Moving back to transacting in cash, outside the formal financial system, claws back the gains that have been made. #CitizenExplainer pic.twitter.com/u4oHHsfXvQ

— Kenya Bankers Association (KBA) (@KenyaBankers) May 28, 2024

Repercussion of shunning banks

With the expected massive exodus from formal financial institutions, Molenje raised fears that Kenya would turn into a cash economy.

According to Molenje, the implications of a cash economy include limited access to loans from both lenders.

“When they move out of the formal transactions, they will not be able to access the banks and digital loans,” Molenje asserted.

Further, he warned that businesspeople will start leaving in fear of losing their money due to the cash accumulated in their sales.

To avert the outcome, the Kenya Bankers Association appealed to President William Ruto’s administration to slow down some tax measures.

The reassurance provided by the Departmental Committee on Finance and National Planning regarding the tax proposals in the Finance Bill 2024 demonstrates a commitment to thorough scrutiny and stakeholder engagement in the legislative process.

Chairperson Kimani Kuria’s acknowledgment of the importance of reviewing the impact of previous finance acts to inform decisions on the current bill reflects a responsible approach to policymaking.

By conducting public hearings and soliciting input from stakeholders, the committee aims to gather diverse perspectives and insights on the potential implications of the proposed provisions.

This inclusive approach fosters transparency and accountability, ensuring that the concerns and interests of various stakeholders, including businesses, taxpayers, and financial institutions, are taken into consideration.

The committee’s pledge to carefully evaluate the provisions of the Finance Bill underscores the significance of balancing revenue-raising measures with the need to promote economic growth, investment, and financial inclusion.

By conducting a comprehensive review, the committee seeks to make informed decisions that will contribute to the overall welfare and stability of Kenya’s economy.

Ultimately, this assurance from the committee reflects a commitment to responsible governance and effective policymaking, which is essential for fostering trust and confidence in the legislative process.

It provides reassurance to stakeholders that their voices will be heard and their concerns will be addressed as the Finance Bill 2024 is deliberated and finalized.

“I want you to have a look at the Finance Act of 2024 when it is finally enacted, and compare it with the current Bill that we’re considering, and see the difference. We are keen to realise a progressive law that will help claw back economic growth,” Kimani assured.