Leaders of top savings and credit co-operative organizations (Saccos) have been borrowing heavily from banks to pay substantial dividends to their members, despite experiencing low annual profits, according to Cooperative and MSMEs Cabinet Secretary Wycliffe Oparanya. He highlighted that many Saccos are facing liquidity challenges, making it difficult for them to service their loans, a situation that has contributed to poor governance within these organizations.

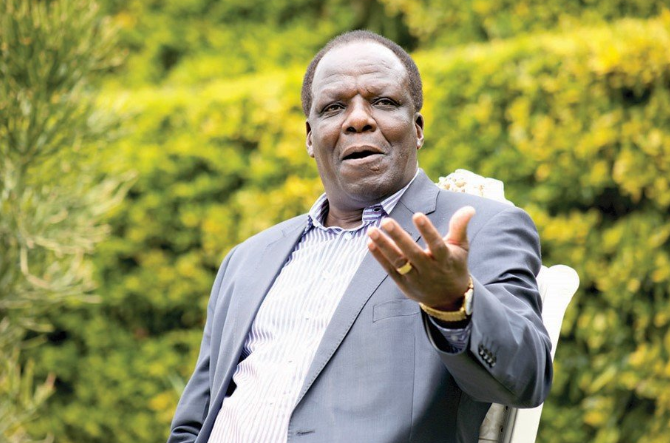

“Investigations by the government have confirmed that some financial co-operative leaders have resorted to unethical business practices, such as borrowing to pay dividends rather than basing these on the actual annual profits earned,” Oparanya stated.

This behavior, he added, has led to unmanaged debts for the credit unions, resulting in challenges with regulators and diluting the principles of good governance and professional conduct among their managers. Oparanya made these remarks during the National Ushirika Adjudication Award ceremony for co-operatives held at a Nairobi hotel.

The awards were originally scheduled for July but were postponed due to countrywide protests. “Dividends should be declared based on profits, not borrowed money. If you’ve already incurred a loss, why then borrow to appease your shareholders? This is unethical and will not be tolerated,” he emphasized.

Annual dividends are typically paid from profits earned or retained earnings. Liquid Saccos benefit from significant retained earnings, which allow them to pay dividends in some cases even from retained earnings. Oparanya also confirmed that a similar problem is escalating in the coffee sub-sector, where co-operative leaders of primary societies are also resorting to heavy borrowing to pay farmers high earnings that exceed their actual income.