Kenyans cashed out Sh30.8 billion of their money from savings and credit cooperative societies (Saccos) last year as economic hardships pushed them to the edge.

Sacco Societies Regulatory Authority (Sasra) latest disclosures show that the withdrawable deposits (also known as Fosa savings), which are usually held by Saccos as demand deposits, dropped by 26.9 percent to Sh83.78 billion from Sh114.59 billion.

“This can be attributed to the high costs of living, which resulted in members withdrawing the savings for consumption purposes,” says Sasra in the latest supervision report.

“The harsh macro-economic conditions prevailing during most of the year 2022 such as high inflation and exchange rates and droughts meant that a majority of members of Saccos had their disposable incomes greatly reduced, and this resulted in low voluntary savings.”

This marked the second straight year of savers dipping their hands in their savings. Sacco savers had cashed out Sh10.46 billion the previous year, cutting the Fosa savings in Sasra-supervised Saccos from Sh12.05 billion.

Fixed deposit savings dipped by Sh1.31 billion from Sh22.33 billion to Sh21.02 billion in the review period.

Sasra sees the elevated inflation as hurting the ability of members to save more money this year, forcing some Saccos to borrow to fund members’ borrowing appetite.

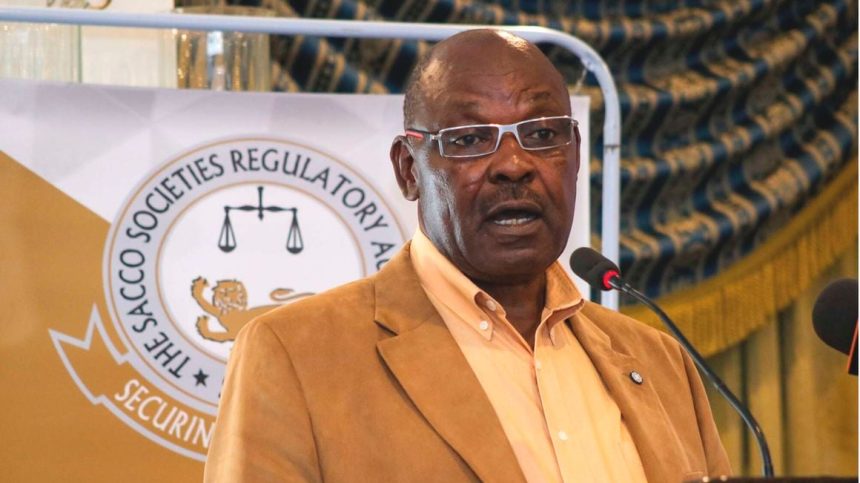

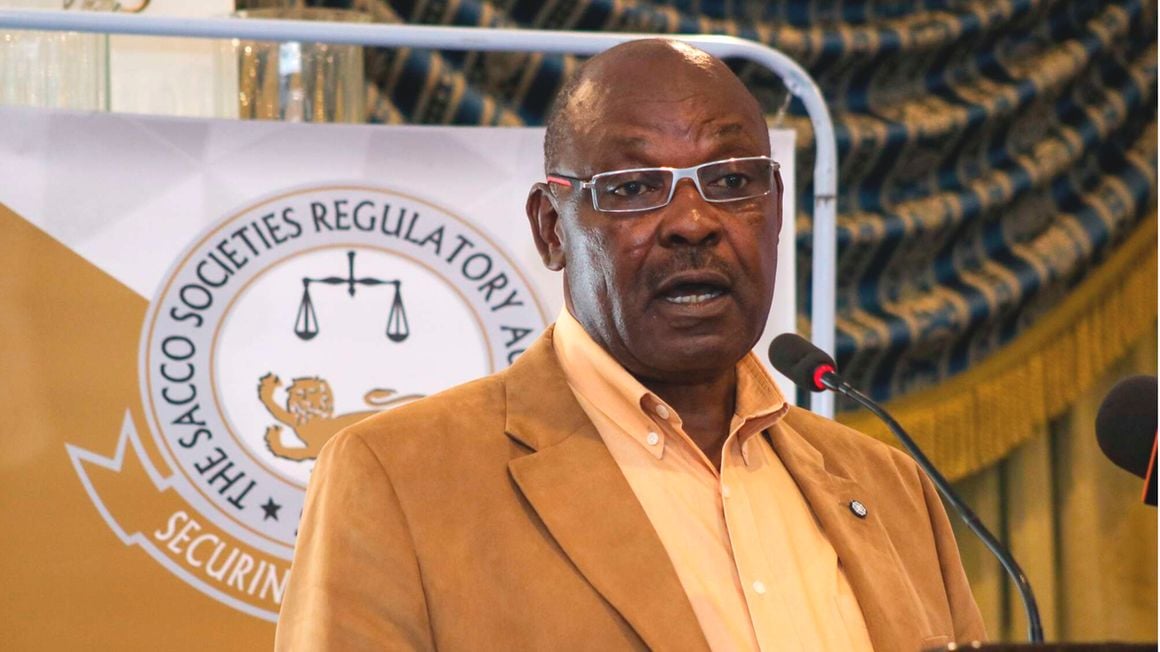

“The high inflation and interest rates, which are projected to continue in 2023 are likely to reduce the savings propensity of members of Saccos thus undermining the Saccos’ ability to mobilise savings from members, while expensive external borrowing will have the potential of increasing their cost of doing business,” said Jack Ranguma, chairperson at Sasra.

The dip in withdrawable and fixed savings came in the period economic challenges also saw the number of dormant members in deposit-taking (DT) and non-withdrawable deposit-taking (NWDT) Saccos jump from 1.18 million to 1.22 million.

Sasra defines dormant members as those who had not made any financial transactions with their respective Saccos for six and 12-month periods for DT-Saccos and NWDT-Saccos, respectively, before the end of last year.

The back-to-back decline in voluntary savings is in contrast with 2020 when these savings jumped by 85.3 percent to the peak of Sh125.5 billion.

Sasra says the rise in voluntary savings despite Covid-19 disruptions was informed by the government’s economic incentives including tax waivers, which alleviated the economic hardships and increased people’s propensity to save.

Overall, total savings for the Sasra-regulated Saccos grew by 9.84 percent to Sh620.45 billion at the end of last year compared to Sh564.89 billion in the preceding year.

The growth in deposits was helped by the non-withdrawable deposits, also known as Bosa savings, rising by 20.5 percent to Sh515.65 billion to account for 83 percent of the total deposits.

“The increase in the Bosa savings can be explained by the fact they are mandatory in nature, while the Fosa saving are voluntary and easily accessible by members in case of need,” said Sasra.