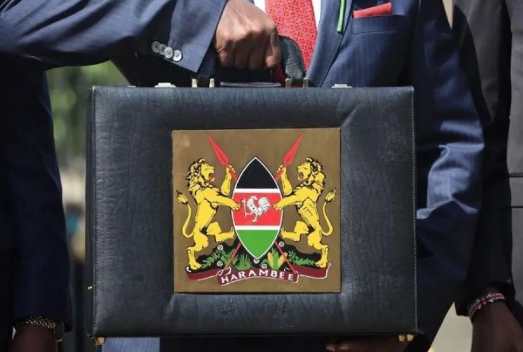

Treasury is now facing a significant challenge in managing the country’s expenditure for the next financial year, starting next week, following the withdrawal of the contentious Finance Bill 2024. President William Ruto announced on Wednesday that he would not sign the Bill, which had sparked nationwide protests due to concerns of over-taxation.

The President’s rejection of the Bill in its entirety, with a recommendation to delete all clauses, leaves Treasury with a Sh302 billion shortfall in projected revenues for the 2024-25 Sh3.9 trillion budget, alongside borrowing. The Kenya Revenue Authority (KRA) had been given a target of Sh2.92 trillion for the next financial year, up from the current Sh2.57 trillion, which is now expected to fall short by at least Sh300 billion.

This shortfall means Treasury will have to operate on a very tight budget for the next financial year, likely leading to major cuts in spending. These cuts are expected to affect service delivery to Kenyans and may result in the stalling or cutting of development projects.

In response, President Ruto directed further austerity measures to reduce expenditure, starting with the Executive Office of the President and extending to the entire executive arm of government.

“I direct that operational expenditure in the residency be reduced to remove allocations for the confidential vote, reduce travel budget, hospitality and purchase of motor vehicles, renovations and other expenditures,” the President said.

President Ruto further proposed that Parliament, the Judiciary, and County Governments, in coordination with the National Treasury, also undertake budget cuts and austerity measures to ensure the country lives within its means. This proposal follows an earlier Cabinet decision to cut spending.

As a result, the Treasury will need to make significant reductions in key allocations across ministries and state departments, aiming to adjust spending below Sh3.9 trillion, possibly averaging the current financial year’s Sh3.7 trillion budget. Counties are expected to be among the hardest hit, with the possibility of their allocations falling below Sh400 billion.

Additionally, budgets for roads, agriculture, social protection, and the Teachers Service Commission face further cuts. Initially, there were plans to slash their budgets by Sh15.1 billion, Sh6.7 billion, Sh5.5 billion, and Sh18.9 billion, respectively.

Now, these sectors may experience even deeper cuts as Treasury CS Njuguna Ndung’u navigates the challenge of maintaining operations for both national and county governments.

Ministries that Treasury is also likely to raid includes education, which has the biggest allocation of Sh656.6 billion in the 2024-25 budget, energy, ICT and infrastructure with a budget of Sh477.2 billion, and national security with an initial proposed allocation of Sh377.5 billion.

Employment in government is also likely to be frozen for longer to tame the high recurrent expenditures (which includes salaries, operations and maintenance), which had been set to go up to Sh2.84 trillion, from Sh2.53 trillion.

Cabinet Secretary Njuguna Ndung’u had projected the fiscal deficit including grants at Sh597.0 billion, down from Sh925.0 billion in 2023-24.

“The fiscal deficit will be financed by net external borrowing of Sh333.8 billion and net domestic borrowing of Sh263.2 billion,” he said during the budget reading.

The deficit is however expected to go up amid increased borrowing on the back of revenue shortfalls where KRA has been struggling to meet its targets.

A budget deficit occurs when a government spends more than it collects in taxes. Reducing tax rates may also cause a deficit if spending is not reduced to account for the decrease in revenue.

Experts foresee changes with supplementary budgets.

“We have seen supplementary budgets which are not very emotive being used to sneak in some expenditures, so it might still go up,” said Ken Gichinga, Chief Economist at business analytics consulting firm–Mentoria Consulting.

The government has been under pressure from IMF and the World Bank to raise more revenues to meet its budgetary obligations, including debt repayment, where the country has in recent times been at risk of default.

Of every Sh10 collected as tax, about Sh6 is said to go into debt repayment. The country’s debt stood at Sh10.4 trillion as of March.