The Treasury has set monthly cash limits to government ministries, departments, and agencies (MDAs) and restricted recruitment of new staff, promotions and pay rise deals as part of wide-ranging measures to deal with wastage of public funds amid tight budget conditions.

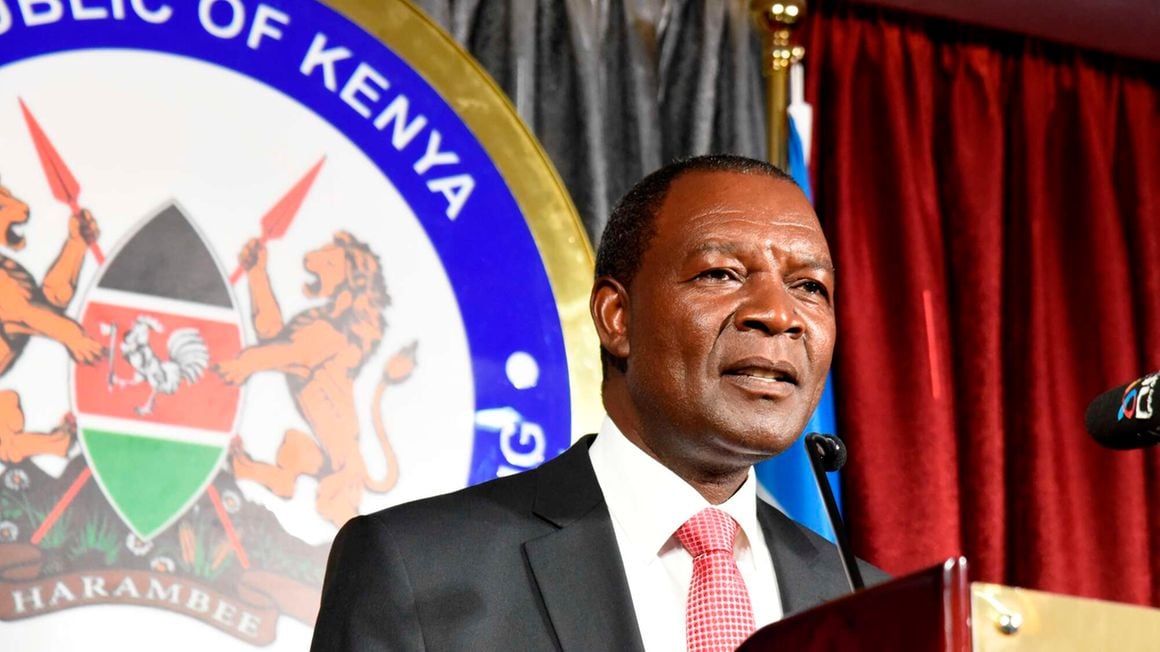

Treasury Cabinet Secretary Njuguna Ndung’u said the fixed monthly cash disbursements to MDAs will be tied to available funds with priority given to four categories of expenditure.

“Cash planning and setting of cash limits are intended to ensure more predictable execution of the budget, and consequently delivery of services and public investments,” Prof Ndung’u said in a circular to accounting officers of MDAs seen by the Business Daily.

In the new disbursement plan, category one expenditures will cover statutory obligations, including debt outflows, salaries, cash transfers to elderly and other vulnerable groups, pensions, and county equitable share.

The second category comprises major social, economic, accountability, governance, and security programmes, including core services and investments.

The third expenditure group includes all other government of Kenya financed expenditures not in category one or two.

The fourth expenditure category comprises externally funded projects categorised as revenue in the budget and for which funds are transferred to the exchequer.

“To enable a structured disbursement of cash to MDAs, the National Treasury will provide monthly cash limits for each quarter based on projected available cash for category 1, 2 and 3 expenditures and consequently, meet requests related to category 1 and 2 expenditures promptly and category 3 when cash is available in line with withdrawal requests,” Prof Ndung’u said.

The Treasury restrictions also target personnel expenditure on hiring, promotions to higher ranks, or collective bargaining agreements with trade unions that have cost implications.

“Accounting officers should note that recruitment of new staff, replacement, upgrading or promotion of staff should only take place after MDAs have obtained written confirmation of the availability of funding from the National Treasury, and necessary approvals from the relevant entities in the public service mandated to undertake recruitment,” the CS said.

“All proposed collective bargaining negotiations with trade unions representing public officers with cost implications must be referred to the National Treasury to confirm the availability of funds before seeking the necessary advice from the Salaries and Remuneration Commission.”

In a further move aimed at streamlining expenditure, the Treasury has banned commitments for the supply of goods and services without prior approvals that are tied to available funds.

“All commitments for the supply of goods and services shall be done by May 31, 2024. No commitments shall be entered into without adequate provision. Accounting officers shall ensure that no unauthorised, irregular, or wasteful expenditures are incurred. Immediate corrective measures and disciplinary action should be taken against any public officer who commits an act of financial delinquency,” the CS said.

Payments through the Central Bank of Kenya(CBK) will only be processed for goods and services already rendered or received.

“Accounting officers should note that payment instructions to CBK should only be issued against net exchequer approved and collected appropriations in aid. Payment should only be made for goods and services received or rendered,” Prof Ndung’u said.

Historical pending bills and 2022/23 carryover internet banking commitments will be handled based on the recommendations of a multi-agency pending bills committee.

The Cabinet this week approved the formation of a special committee to audit the more than Sh537.2 billion pending bills before payment could start.

During a Cabinet meeting chaired by President William Ruto on Tuesday, it was agreed that the team would have a working timeline of up to a year to present its findings.

Treasury data show that the outstanding national government pending bills stood at Sh537.2 billion as of the end of March, representing a 23.6 percent growth from Sh434.5 billion in a similar period last year.

The government faces a tough balancing act to finance its 2023/24 budget amid tough economic times. President William Ruto’s maiden budget of Sh3.68 trillion is 8.6 percent higher than the financial year 2022/23 of Sh3.39 trillion.

This leaves an expected Sh720.1 billion deficit which would comprise about Sh198.6 billion borrowed externally while Sh521.5 billion will be sourced domestically

The 2023/24 revenue is projected at Sh2.89 trillion. Of this, Sh2.57 trillion is ordinary revenue — revenue from income tax, VAT, duties, and investment.