The recent events surrounding the Finance Bill 2024 in Kenya have unfolded dramatically, with significant implications for both the government and opposition coalitions.

The decision by Kenya Kwanza to backtrack on contentious taxation measures, including the proposed 16 per cent VAT on bread, followed widespread public outcry and spirited protests that brought Nairobi’s CBD to a standstill.

The government’s response to the public uproar reflects concerns about potential economic disruptions and the impact on President William Ruto’s popularity. There were fears that the protests could escalate into nationwide demonstrations, reminiscent of past events that had a significant economic toll.

Additionally, the looming standoff in Parliament between Kenya Kwanza and Azimio added pressure on the government to reconsider its position. The call by the Azimio coalition to whip its MPs to reject the Finance Bill further intensified the political confrontation within the legislature.

“Good afternoon Hon Members of the National Assembly. Upon consultations, we have scheduled a PG meeting in the mini-chamber at county hall on Tuesday, June 18, 2024, at 5 pm.

The meeting shall deliberate on the Finance Bill and chart the strategic way forward. Let’s endeavour to acquaint ourselves with the Bill before that time. Physical attendance is mandatory,” reads an invite by Wandayi.

Raila Odinga has not called for protests over the Bill but there are fears that given the level of organisation on Tuesday, a rallying call by the opposition would worsen the situation for the government.

Raila had last week called for a radical surgery on the Finance Bill, 2024 saying most of the tax proposals “are as insensitive as they are callous”.

“The Finance Bill 2024 fails the taxation dictums of predictability, simplicity, transparency, equality and administrative ease and fairness,” he said.

“It is worse than the one of 2023, an investment killer and a huge milestone around the necks of millions of poor Kenyans who had hoped that the tears they shed over taxes last year would see the government lessen the tax burden in 2024,” Raila added.

The situation surrounding the Finance Bill, 2024 in Kenya has revealed significant challenges and tensions within the government, particularly regarding proposed taxation measures and the need to raise local revenues. President William Ruto’s commitment to increasing revenue through local sources has faced opposition from various sectors, including the informal and formal business community, who fear the potential negative impact on the local economy.

Internal dissent within the Kenya Kwanza coalition, exemplified by Deputy President Rigathi Gachagua’s alleged mobilization efforts in his Mount Kenya stronghold, has further complicated the situation.

The opposition from both Azimio and some Kenya Kwanza MPs has threatened to derail the passage of the Finance Bill, which is essential for implementing revenue-raising measures and ensuring financial stability for the government.

The urgency of passing the Finance Bill before the start of the new budget cycle underscores the critical nature of the situation. Failure to enact the bill could lead to a financial crisis, as the government would lack the necessary budgetary framework to operate effectively.

In response to mounting pressure and in an attempt to address public concerns, the government has opted to drop certain proposed revenue-raising measures from the Finance Bill.

“We through the committee have listened to you,” National Assembly Majority Leader Kimani Ichungw’ah said.

The Bill will come up for the Second Reading on Wednesday and Thursday ahead of voting probably next week.

“We will allow the weekend for any amendments to the Bill,” Ichungw’ah added

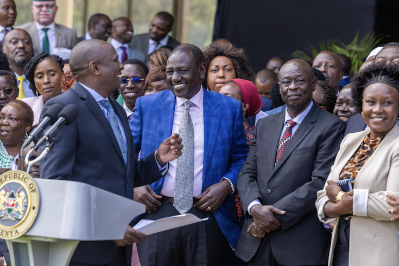

The decision to drop several contentious tax proposals from the Finance Bill, 2024, marks a significant development following a meeting chaired by President William Ruto at State House.

Molo MP Kimani Kuria, addressing Kenyans after the meeting, announced the changes, which include the removal of 16% VAT on bread, excise duty on vegetable oil, VAT on transportation of sugar, 2.5% motor vehicle tax, and eco levy on locally manufactured products.

Furthermore, adjustments have been made to ease the burden on farmers and small businesses, with the eTims receded for those with a turnover below Sh1 million.

Excise duty has also been imposed on imported table eggs, onions, and potatoes to protect local farmers. Additionally, the government has withdrawn proposed increases in mobile money transfer charges and VAT on financial services and foreign exchange transactions.

Moreover, to support small businesses, the threshold for VAT registration has been raised from Sh5 million to Sh8 million.

This adjustment aims to reduce the administrative burden on small enterprises, allowing them to focus on growth and development without the added complexity of VAT registration.