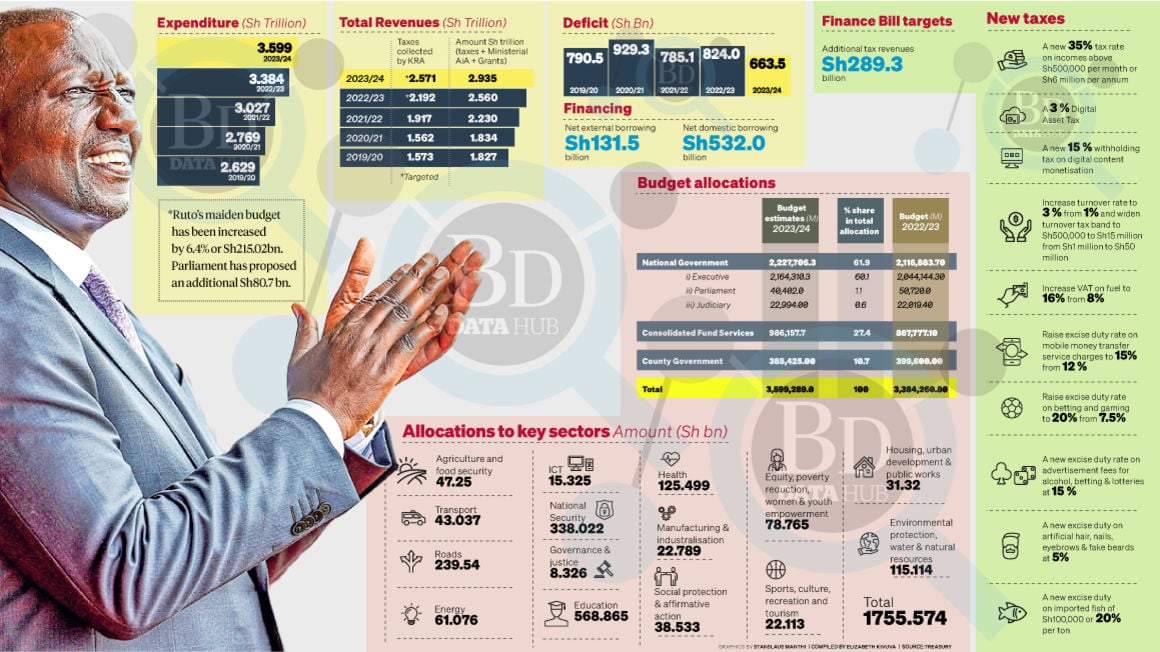

The government’s spending plan for the year ending June 2024 has been increased by Sh215.02 billion, pointing to more tax pain for households and businesses.

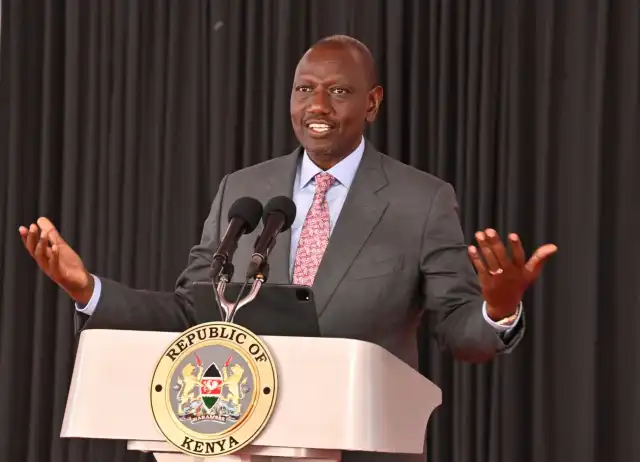

The budget summary shows the new administration of President William Ruto has set the total expenditure for the financial year 2023/2024 at Sh3.599 trillion, comprising Sh2.477 trillion for recurrent and Sh689.1 billion for development.

This represents a 6.4 percent or Sh215.02 billion rise over the Sh3.38 trillion budget by the administration of former President Uhuru Kenyatta, who handed over power last September.

The parliamentary Budget and Appropriations Committee on Wednesday recommended an additional allocation of Sh80.7 billion, which would raise the budget for the financial year 2023/2024 to Sh3.679 trillion.

President Ruto’s government targets growing total revenues, including Appropriation in Aid (AiA), to Sh2.893 trillion. Tax collections by the Kenya Revenue Authority (KRA) are projected to be Sh2.571 trillion.

Dr Ruto’s first budget comes amid an expected shortfall in revenues collected by the tax authority for the year ending this month in a tough economic environment.

The KRA collected Sh1.393 trillion in taxes in the nine months to March 2023, against a target of Sh2.108 trillion, pointing to below-target collections for the year starting July.

This could force the government, already grappling with high public debt distress, to intensify efforts to ease a cash crunch.

The government has announced measures targeting both the rich and low-income earners as it focuses on growing domestic revenues to cut on borrowing and scale up collection by the KRA to Sh3.0 trillion.

It plans to expand the tax base in a move that will see it train its sights on the informal sector and go after small businesses making sales as low as Sh41,000 per month.

An MSME survey found that the potential taxable base in the informal sector was Sh2.8 trillion.

The government further plans to conduct a census of landlords’ properties and seek direct access to M-Pesa transactions in effort to catch tax cheats through the integration of the KRA’s tax system with telecommunications companies.

Landlords with annual rental income of between Sh288,000 (Sh24,000 per month) and Sh15 million (Sh1.25 million per month) are required to file a monthly tax return declaring the gross earnings rent from which tax payable is computed at the rate of 10 percent.

The Finance Bill 2023 targets additional tax revenues of Sh289.3 billion through measures such as increasing the turnover rate to three percent from one percent and widening the turnover tax band to Sh500,000 to Sh15 million from Sh1 million to Sh50 million.