The ultra wealthy and large investors have undermined Kenya’s attempt at growing tax revenues from a wide raft of tax incentives and exemptions handed down to them in the past decade.

According to an analysis of the tax policy and administrative changes in East African Community countries by the International Monetary Fund (IMF), Kenya’s tax-to-GDP ratio has been falling since peaking in 2014.

The IMF analysis tracked tax policy and administrative changes between 1988 and 2022, revealing the bulk of changes undertaken in Kenya resulted in a reduction of taxes payable.

“While in all the EAC countries except Rwanda and Uganda, tax changes primarily consisted of base changes, in Kenya base-narrowing measures were announced more frequently than measures to strengthen administrative practices. Kenya was also the only country in the sample where the frequency of tax policy changes introducing a reduction in taxpayers’ liabilities exceeded 60 percent of total tax policy changes,” the IMF said.

“While the frequency of tax measures is not an indicator of the actual revenue impact of a tax measure, it does provide an indication of the likely direction of change in tax collection if specific measures are sustained over time where frequent introduction of base-narrowing measures would result in an erosion of the tax base.”

Kenya has since 2014 issued an array of incentives and exemptions on personal income tax, corporation tax, VAT and trade taxes resulting in the observed decline in the share of taxes to total GDP output.

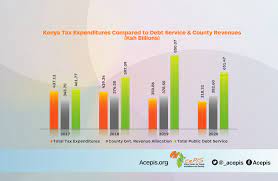

The country’s tax revenues have steadily fallen since peaking at 15.5 percent of GDP in 2014 and touched a low 13.1 percent of GDP in 2020.

The implementation of the 2023 Finance Act, despite its ambitious target to improve tax revenues, is expected to only lift the tax-to-GDP ratio to just 14.4 percent of GDP.

According to an analysis of recent tax measures, incentives granted to the rich and large investors are likely attributable to the drag on tax revenues.

In 2014 for example, aeroplanes and other aircraft exceeding 2,000 kilogrammes in weight were exempted from VAT, handing relief to rich individuals and companies who import such equipment into the country.

But 2015 saw the legislation of key incentives for Special Economic Zone (SEZ) enterprises, developers and operators who were exempted from all taxes and duties payable under the Excise Duty Act, Income Tax Act, East African Community Customs and Management Act and the VAT Act.

The special incentives are aimed at attracting large domestic and foreign investors into making investments in the SEZs. Other incentives and exemptions handed down in recent tax legislations are reduction of corporate income tax rate from 30 percent to 15 percent to real estate developers putting up at least 400,000 housing units in a year of income.

In 2016, motor vehicles purchased or imported for the direct and inclusive use in official aid and funded projects were exempted from VAT.

Most recently in 2023, aircraft parts were exempted from VAT while developers of hotel buildings and buildings and machinery used in manufacturing were cleared for a 100 percent investment deduction.

Bulk storage and handling facilities supporting SGR operations were also qualified for a 150 percent investment deduction.

Last year’s move to cut taxes for local branches of foreign companies has also resulted in reduced liabilities for the firms which have saved billions in the process.

Read: Kenya targets US investors with tax relief

US power generating company Ormat Technologies Inc, for example, disclosed a tax benefit of $9.4 million after the reduction of its corporate tax rate from 37.5 percent to 30 percent as did American Tower Corporation.

Such savings came at a time Kenyans were straining under the weight of mounting taxes and levies, including increased payroll deductions such as the National Social Security Fund and the expected state-backed Social Hospital Insurance Fund.

Other tax measures added to the pressure and implemented under the 2023 Finance Act are the doubling of VAT on petroleum products and the introduction of the 1.5 percent housing levy which is to be matched by employers.

The IMF has called for the reversal of measures narrowing the tax base starting with the implementation of the Medium Term Revenue Strategy (MTRS).

“Kenya needs to strengthen tax collection consistent with the authorities’ objectives of sustained increase in tax revenues to meet their development agenda. In this regard, a key milestone is the timely adoption of Kenya’s first MTRS which aims to increase revenues by five percentage points of GDP by FY2026/27 through measures that broaden the tax base and strengthen tax compliance,” the IMF added.