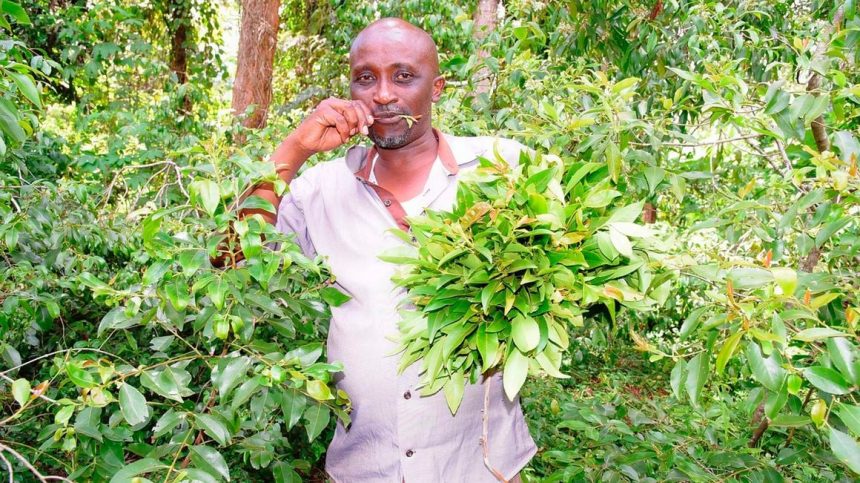

Alexander Mwenda, a Miraa farmer in Gaciongo, Igembe North chopped down his earlier treasured trees three weeks ago sparking uproar, shock and disbelief among other growers and dealers in Meru county.

Mr Mwenda has been in the miraa-growing venture for two decades but was irked by the low prices and hired a power saw, which cleared a two-acre farm. He planted avocado trees instead.

“It had become worthless because instead of earning me more than Sh100,000 per harvest as was the case, over the past three years I have been earning less than Sh20,000,” he said in an interview with Business Daily. But he still has eight more acres of the crop.

Mwenda is not alone. Thousands of miraa growers have been frustrated by the poor turn of events in the business that has seen earnings from the “green gold” plummet due to the loss of foreign market among other factors.

Kamakia Arunga, a farmer in Igembe South for over 30 years says the situation has worsened especially during dry seasons when their crop dries.

“We were promised that boreholes would be drilled to enable us to irrigate our crops but nothing has been done so far. I am also contemplating cutting down my trees and seeking alternatives,” said Arunga.

Players also claim cartels are reaping from their woes.

President William Ruto, who visited the region recently, reiterated his commitment to kick cartels out of the agricultural sector and cushion farmers from poor pay for their produce.

“In our Kenya Kwanza plan, we aim to eradicate cartels in the agricultural sector and redesign the entire mechanism. We must sort out the agricultural sector and I must tell you that we will no longer continue like this,” Dr Ruto said.

But farmers and traders say middlemen have dominated the export market to a level of controlling the volumes sold out.

Chairman of the Miraa Growers and Traders Cooperative Union, Mr Moses Lichoro, said after the Somalia export market was opened in July last year after two years of closure, new levies were introduced, which has increased the cost of the commodity to the destination making it unattractive.

“When the market was opened we used to sell 100 kilogrammes at Sh200,000 but it was reduced to Sh80,000 because exporters said they were not getting good market for our produce, which is a lie,” Mr Lichoro said.

Considered a mild stimulant, miraa is banned in the US, India, the United Kingdom, the Netherlands, several other European countries and neighbouring Tanzania.

In Kenya, several counties including Mombasa, Kilifi, Garissa and Kwale have in the past attempted to control its use by imposing legislations that have largely been ignored.

The National Authority for the Campaign Against Alcohol and Drug Abuse (Nacada) has also maintained that miraa is a drug and placed it in the same category as cocaine and other hard drugs, with leaders in Meru mounting a spirited effort to have the authority declassify the stimulant.

Kenya Bureau of Standards has, however, developed standards that are expected to guide the exploitation of the stimulant in value addition, which will see the processing of chewing gum and wine among other products from khat.

The rain started beating the over 150,000 farmers when exports to the United Kingdom were banned in June 2014.

At the time of the ban, records indicated that around 2,560 tonnes of khat worth $23.4 million (Sh2.3 billion) were exported to Britain between 2011 and 2012.

After exports to Somalia were suspended in March 2020, Nyamita estimated that farmers and traders were losing Sh16 million daily, with losses amounting to over Sh11.5 billion up to July 2022 when the move was rescinded.

The Meru County Integrated Development Plan (2018-2022) also projected that annual earnings from the crop would hit Sh9.5 billion by last year.

After the lifting of the ban, the Miraa, Pyrethrum and other Industrial Crops directorate at the Agriculture and Food Authority (AFA) reported that farmers exported 375,000 kilogrammes (375 tonnes) to Somalia alone, worth Sh1 billion during the month of August.

This means that the potential for the export market is worth over Sh12 billion every year. The figures for exports to Somalia indicate that each kilogramme was going for an average of Sh2,600 but currently, traders say while the price has reduced to less than Sh2,000 a kilogramme, quantities are limited.

A largely informal sector whose taxes were not determined until recently, the value of the miraa trade is yet to be accurately determined especially locally.

Currently, the government is levying $4.5 (Sh630) per kilogramme of exported khat.

Recognition of Miraa as a cash crop by the Agriculture Ministry in 2016 and the subsequent allocation of Sh1.2 billion for its development also boosted the sector, although the implementation of projects was marred by politics and misappropriation of funds.